C The recovery of the US dollar stopped the rise of gold, and thus the price returned to the level of $1771 amid profit-taking sales, before the price of gold stabilized around the level of $1780 as of this writing. The pair is waiting for the dollar to complete its gains and react to the economic data and important events for this week. The dollar got stronger amid the possibility of a rate hike at some point in the near future.

US Treasury Secretary Janet Yellen said in an interview that the Fed may have to raise interest rates to prevent the economy from overheating. The dollar’s strength was also due to comments from Fed Chairman Jerome Powell, in which he said that the US economic outlook has clearly improved amid vaccination rates and faster fiscal stimulus. However, he warned that the economy "is not out of the woods yet". "As the recovery picks up steam, it has been slower for those in low-paying jobs," Powell said at the National Community Reinvestment Coalition event at the start of the week.

In the same performance as gold, silver futures closed lower at $26.558, after rising more than 4% in the previous session. Copper futures settled at $4.5215.

New orders for US manufactured goods showed a remarkable rebound in the month of March, according to a report released by the Commerce Department yesterday. The announcement said US factory orders jumped 1.1% in March after falling by a revised 0.5% in February. Economists had expected factory orders to increase by 1.3% compared to the 0.8% decline originally announced from the previous month.

Meanwhile, a separate report by the US Commerce Department showed that the US trade deficit widened to a new record high in March, reaching $74.4 billion, up from $70.5 billion in February. The politically sensitive trade deficit with China rose 11.6% to $27.7 billion, which was usually the largest deficit of any single country.

During the first three months of this year, the US trade deficit reached $212.8 billion, an increase of 64.2% over the deficit during the same period last month, at a time when the US economy was mainly closed due to the coronavirus pandemic. The United States recorded a deficit in the whole of 2020 amounting to $681 billion, which is the largest annual gap since 2008, as the virus disrupted global trade.

The US economy is recovering much faster than the rest of the world, and this is evident in the trade numbers as the gap widens. Americans are starting to spend again, while US exporters are facing a slowdown in external demand in countries that are recovering more slowly.

During his four years in office, Trump pursued a strict trade strategy that used punitive tariffs on other countries' products as a way to eliminate America's trade deficit with the rest of the world and restore millions of lost manufacturing jobs.

So far, the Biden administration has not retreated from Trump's policies. Some analysts believe that US President Joe Biden is behaving cautiously because reversing all Trump's policies could increase risks for Democrats close to the unions. Organized workers have long complained about US free trade policies before Trump.

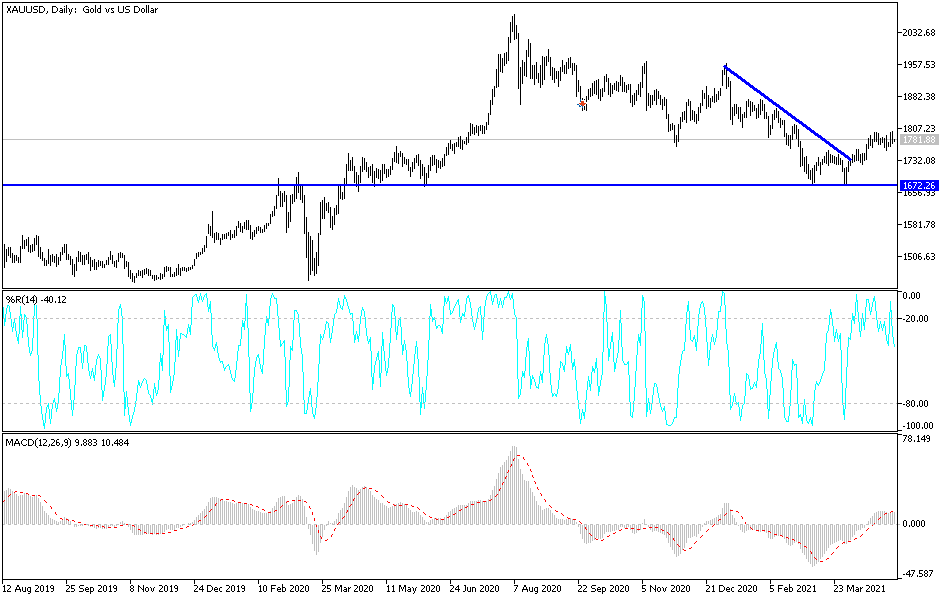

Technical analysis of gold:

Despite the stalling of its gains, the price of gold still has an opportunity to rise, and the bullish performance will continue by breaking through the psychological resistance level of $1800, as it has been trying to do since the start of trading this week. Breaking through this resistance will increase the technical buying process and thus move towards higher resistance levels, the closest of which are currently $1800, $1818 and $1845. On the other hand, bullish hopes may be dashed if the gold price breaks the support level of $1730 an ounce. I still prefer to buy gold from every downside.