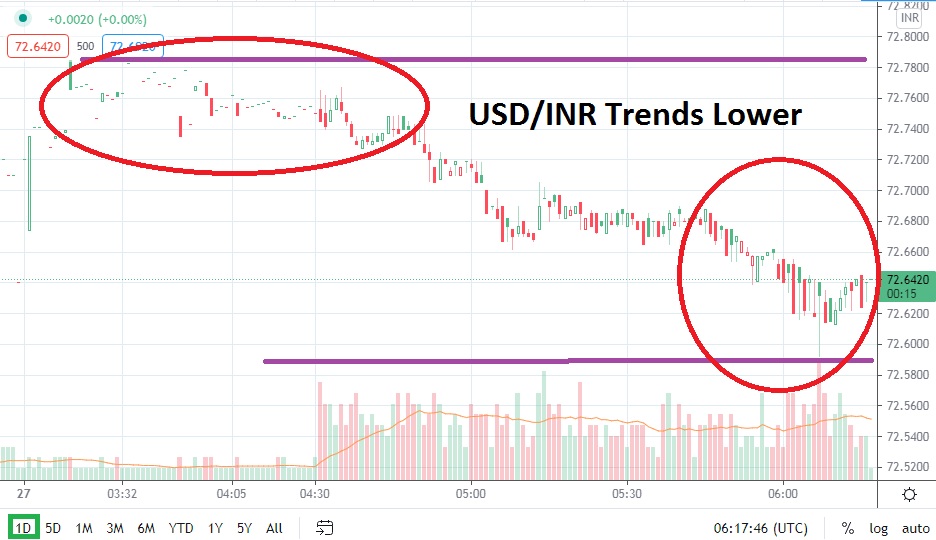

The USD/INR has continued to track lower and has proven support levels vulnerable. The USD/INR has returned to the lower depths of its mid-term price range and is within sight of prices seen from the middle of March until the last week of the month. As of this morning, the price of the USD/INR is near the 72.6400 range.

Resistance levels have been rather durable the past week of trading, and a lack of violent reversals higher has become a feature of the USD/INR. Unfortunately, that doesn’t mean spikes higher will not occur periodically for speculators within the USD/INR; stop losses remain a natural ingredient of the Forex pair’s trading environment. The puzzle short-term traders need to solve and conquer may be a natural instinct which believes that the current bearish trend of the USD/INR eventually has to exhibit a reversal higher.

However, support levels which are currently residing around the 74.5800 to 72.5000 junctures may be quite attractive. Simply put, the trend of the USD/INR has been significant since the end of the third week in April. While it might be a very human quality to be skeptical about the downward momentum of the USD/INR, technically the Forex pair appears to be on a path to re-establish its values which were seen in the middle of March.

Short-term traders who remain sellers should not become overly greedy. Speculators need to know when to cash out winning positions. If profitable trades emerge, traders should not build castles in the air with expectations which may prove to be correct, but are not able to be capitalized. The costs of carrying charges, the amount of leverage being used and small reversals higher can cause emotional distress and make even the best of traders skittish and create negative trades. In other words, quick-hitting trades should be the plan of attack for many short-term speculators.

Traders may want to continue to wager on more downside price action from the USD/INR. Yes, they should remain wary of potential reversals higher which are likely to be witnessed, but the trend of the USD/INR appears to be within a solid technical trajectory as the Forex pair aims for a potential equilibrium with values seen two months ago.

Indian Rupee Short-Term Outlook:

Current Resistance: 72.7050

Current Support: 72.5800

High Target: 72.7700

Low Target: 72.4600