The USD/JPY’s retracement gains this week pushed the pair towards the 109.69 resistance before settling around 109.45 as of this writing. The currency pair managed to benefit from the positive reaction to the latest US economic data. The pair may remain in a narrow range until the US jobs report details are announced next Friday.

The USD/JPY remained stuck to its gains after yesterday's comments by Federal Reserve Chairman Jerome Powell, in which he stated that the economic outlook “has gotten brighter” in the United States, but the recovery is still very uneven with the slowdown in low-income groups. In a speech yesterday, Powell pointed to a number of factors that have brightened America's growth prospects.

"We are not out of the danger stage yet, but I am happy to say that we are making real progress now," Powell said in statements to the National Alliance for Community Reinvestment, pointing to higher levels of vaccinations, increased government support and more reopening of businesses. "The economic downturn has not fallen on the shoulders of all Americans equally, and those least able to bear the burden have been affected the most."

Manufacturing activity growth in the US unexpectedly slowed in April, according to a report issued by the Institute of Supply Management. Accordingly, the ISM said that the Manufacturing PMI fell to a reading of 60.7 in April after jumping to a more than 37-year high of 64.7 in March. While a reading above the 50 level still indicates a growth in industrial activity, economists expected the index to reach a reading of 65.0.

Commenting on the numbers, Timothy R. Fury, chair of the ISM Manufacturing Business Survey, said: "Absenteeism, short-term shutdowns due to partial shortages and difficulties in filling open jobs remain issues that limit the potential for manufacturing growth."

The unexpected decline in the Main Index came as the Production Index fell to 62.5 in April from 68.1 in March and the New Orders Index fell to 64.3 from 68.0. The Employment Index also fell to 55.1 in April from 59.6 in March, indicating a slowdown in the pace of job growth in the manufacturing sector. Meanwhile, the report showed that the Price Index jumped to 89.6 in April from 85.6 in March, reaching its highest level since July of 2008.

On Wednesday, the ISM will release a separate report on service sector activity during the month of April. The ISM Services PMI is expected to rise to 64.3 in April from 63.7 in March.

The World Health Organization is expected to decide this week whether to approve two Chinese vaccines for emergency use against COVID-19, a senior WHO official said. This approval will be the first time that a Chinese vaccine has ever been granted the so-called emergency use list from the United Nations Health Agency, and it will lead to a wider deployment of Chinese vaccines that are already in use in some countries other than China.

Mariangela Simao, Assistant Director-General for Access to Medicines, Vaccines and Pharmaceuticals, says that some "final arrangements" still need to be made before the decisive word comes from the WHO Technical Advisory Group on the Sinopharm and Cinofac vaccines. The World Health Organization said it expects the decision on the Sinopharm vaccine to come first, and Sinovac after that.

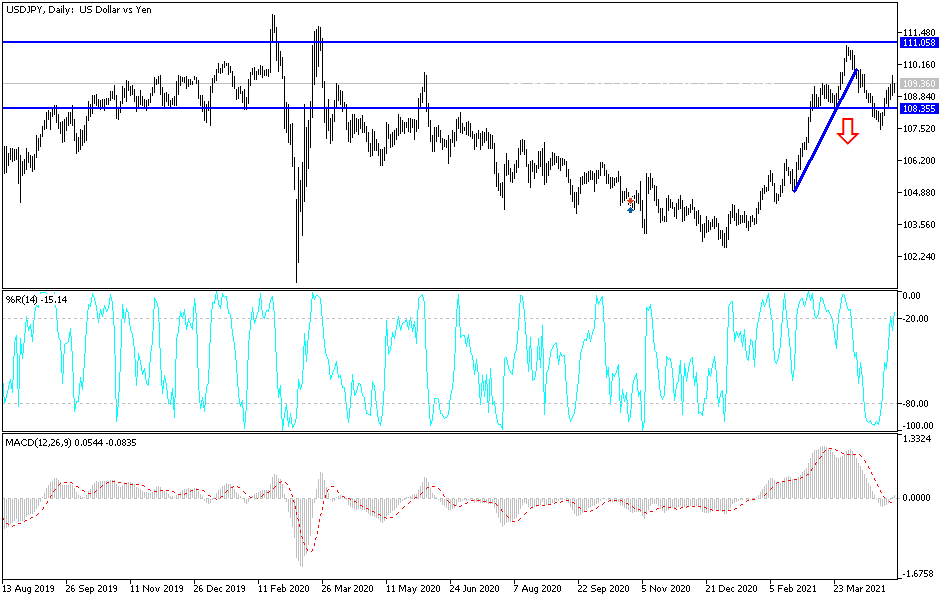

Technical analysis of the pair:

It remains crucial for the USD/JPY to break through the 110.00 resistance to strengthen the bullish performance and trend, paving the way for buyers to move it towards higher resistance levels. These gains may be threatened by the return of investors to buy safe havens in the event that the Indian COVID strain spreads outside its borders and reduces global efforts to vaccinate against the epidemic, or in the event that the US job numbers come in less than expected.

Bears will regain control of the currency pair's performance if it moves towards the support levels of 108.65 and 107.90. The currency pair will be affected by the announcement of the trade balance figures and factory orders in the United States of America.