Investors abandoned the Japanese yen recently due a renewed outbreak of COVID-19 in Japan and the country’s slow pace of vaccinations, which impede the economic recovery of Japan. The pair settled at the beginning of this week's trading around the 109.83 level. The US dollar pairs this week are experiencing a crucial trading wee, which will see the release of the US Department of Labor's report on US job numbers.

The US dollar rose against the other major currencies, backed by strong economic data. The Fed's inflation reading favored showed an acceleration in price growth but not as much as investors had feared. The core consumer price reading showed the pace of price growth accelerating to 3.1% in April from 1.9% in March. While the price increase exceeded economists' estimates, the jump did not appear to be as severe enough to raise concerns about the US central bank's tightening of monetary policy.

The US Federal Reserve has attributed the recent rate increase to “transitional factors” and has repeatedly hinted that it will not consider tightening until rates exceed 2% “for some time”.

On the other hand, data from the US Commerce Department showed that the Core Personal Consumption Expenditures Index in the US rose 0.7% month-on-month in April after a 0.4% increase in March. The PCE Price Index grew by 0.6% in April, the same as the previous month. Personal income fell 13.1% in April, after rising by a revised 20.9% in March. Economists expected personal income to drop 14.2%.

The US consumer sentiment reading from the University of Michigan was revised slightly higher to a reading of 82.9 in May 2021 from a reading of 82.8, matching market expectations. In general, the reading still points to the lowest level of consumer confidence in 3 months.

The latest federal data shows that two-thirds of adults in New York state have received at least one dose of the COVID-19 vaccine. Meanwhile, the number of hospitalized patients statewide has fallen to 1,143, Governor Andrew Cuomo said Saturday. The total is the lowest since October 31. About 46% of 20 million residents are fully vaccinated, according to data released Friday from the US Centers for Disease Control and Prevention. The national average is 40%.

With the US Memorial Day holiday, more US cities and states are abandoning lingering COVID-19 restrictions as vaccination rates rise and the number of infections drops. These are clear signs of progress that reflect increasingly positive health data. Overall, about 50% of the US population has now received at least one dose of the COVID-19 vaccine, according to the latest figures from the Centers for Disease Control and Prevention. About 40% of the population is fully immunized.

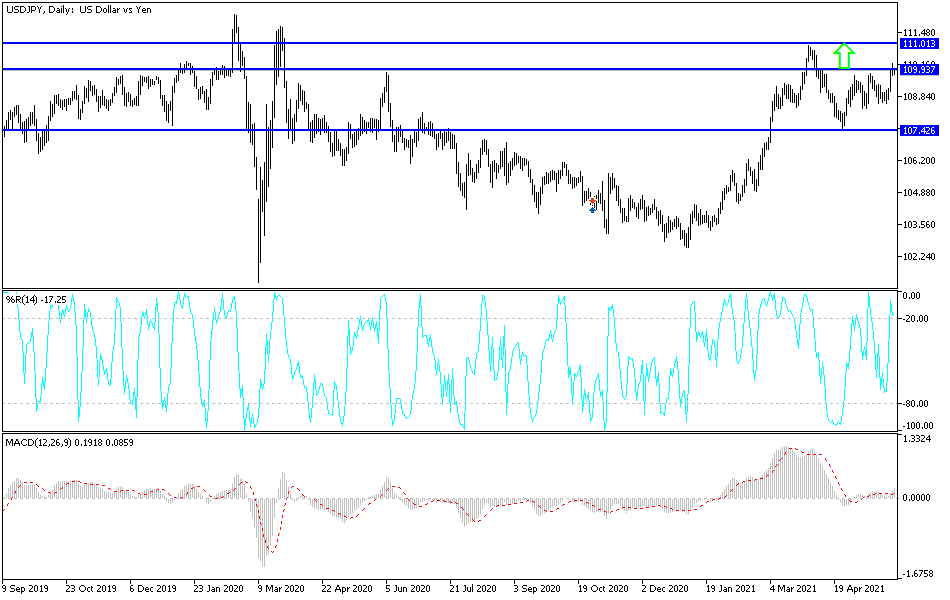

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the USD/JPY currency pair has declined recently after a sharp rise. The pair continues to trade within the formation of an ascending channel, which indicates a significant short-term bullish momentum in market sentiment. Accordingly, the bulls will look to ride the current bullish wave towards the 110.20 resistance or higher to the 110.51 resistance. On the other hand, the bears will target pullbacks around the 109.52 support or lower at the 109.16 support.

In the long term, according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharp bullish channel. The pair approached overbought levels before the recent pullback. This indicates a strong long-term bullish momentum in the market sentiment. Accordingly, the bulls will target long-term profits at around the 111.56 resistance or higher at the 113.56 resistance. On the other hand, the bears will look to pounce on a potential pullback around 107.70 or lower at the 105.74 support.