The West Texas Intermediate Crude Oil market fell a bit during the trading session on Friday only to turn around and rally quite significantly. By doing so, the market ended up forming a bit of a hammer, which suggests that we are going to continue to go higher. The resilience in the market is interesting, especially as the United States reported only 266,000 jobs gained for the month of April. The expected result was 1 million jobs added, so needless to say we did see a sudden knee-jerk reaction of “risk off.”

The US dollar took a hit initially and did continue to lose during the course of the day, but I think the most important thing is that people are paying close attention to the theory of whether or not we will continue to see a lot of demand. Recently, we have seen gasoline demand fall off, perhaps suggesting that the US economy is not firing on all cylinders or perhaps it is a bit “uneven.” I do believe that is the case in various countries around the world, so it certainly makes sense that the oil market struggles to find clarity.

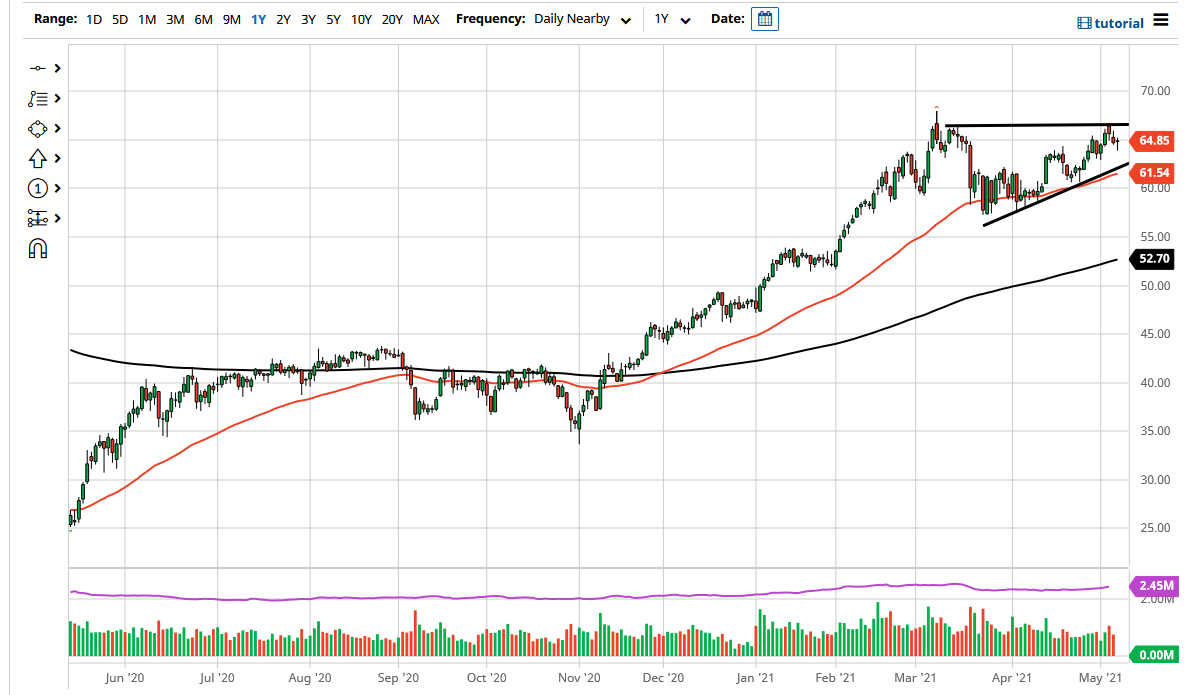

Furthermore, looking at this chart, you can see that we had been very bullish as of late in the fact that we ended up rallying every time this market has dipped. The 50-day EMA is walking up the uptrend line of the ascending triangle, and I think there are plenty of buyers underneath willing to take advantage of value if and when it occurs. To the upside, the $67.50 level looks to be a short-term target, and then the $70 level after that would certainly come into play as well.

If we were to break down below the 50-day EMA, then I think the initial target will be the $60 level underneath there, and then eventually the $57.50 level. If we do break down a bit, then it would make sense that we would find support in that general vicinity. The hammer from the session does look bullish, though, so at the end of the day I think we are much more likely to break up other than to break down. Ultimately, I think the $70 level is the target that most traders are aiming for right now.