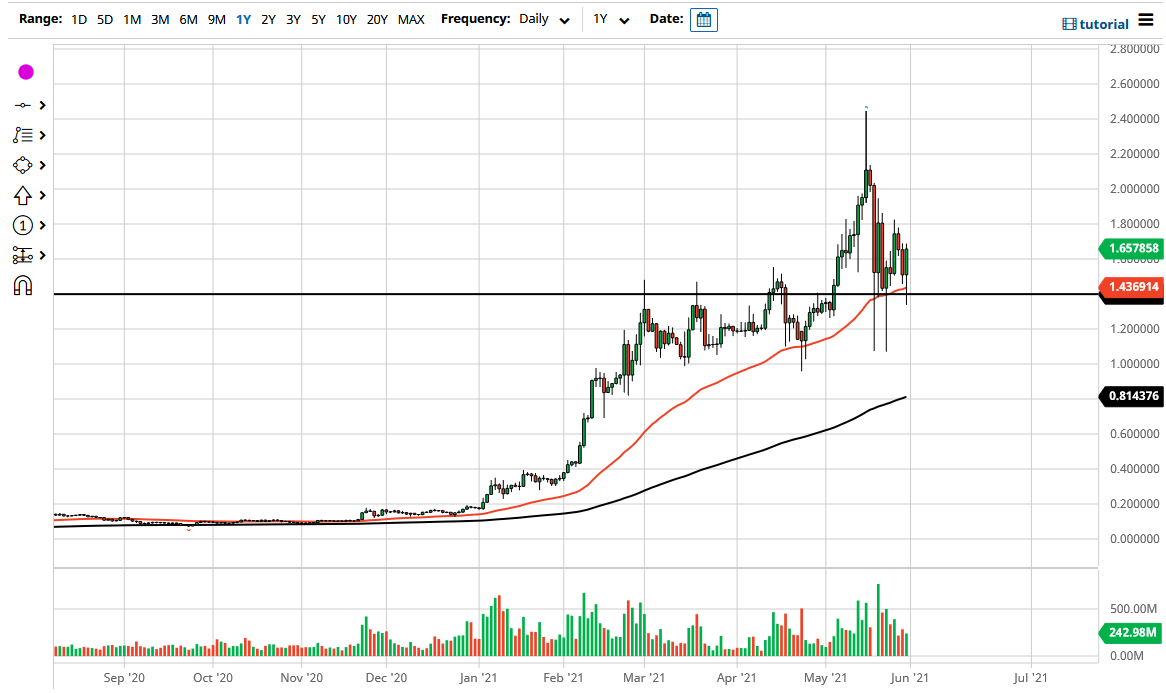

The Cardano market seems to be trying to find support near the $1.40 level, and the Monday session was no different. It initially was a bit of a pullback, but you can see we have turned around completely to gain roughly 10% as we have reached towards the $1.65 level. I do believe that the market is trying to recover from the longer term, and it is worth noting that the 50-day EMA has held quite nicely. Beyond that, we have formed a bit of a hammer which will attract some attention as well.

Bitcoin had recovered a bit during the session as well, and that will be crucial for crypto markets in general to turn things around. We have seen a significant beating in multiple markets, but if the Bitcoin market cannot turn things around, it has a bit of a “knock on effect” in some of the alt coins such as Cardano, despite the fact that Cardano has recently made inroads into being used as a transfer of payment in some African countries, namely Ethiopia.

Unlike so many of the other alt coins, Cardano actually has a use that people can visualize already. Furthermore, it is a heavily staked token, at a clip of over 70% the last time I looked. This suggests that there will be longer-term “buy-and-hold” types of traders out there willing to get involved, so I think what we are going to continue to see is more of a “buy on the dips” attitude. That being said, at this point in time, I believe that the absolute floor in the market is going to be the $1.00 level, an area that obviously would attract a lot of psychological attention. Furthermore, the 200-day EMA has recently broken above the $0.80 level and is rising towards that area, so I believe it is only a matter of time before you would see significant support in that general vicinity.

To the upside, if we can break above the $1.80 level, it is likely that the market will go looking towards the $2.00 level next, perhaps even as high as $2.20. That being said, there has been an extreme amount of damage done to the crypto markets overall recently, and I think that will temper some of the massive rise in price that some people are looking for.