The Ethereum market fell a bit during the trading session on Tuesday to break down below the $2500 level. Crypto markets in general were hit very hard during the session, as traders continue to worry about IRS regulations and government crackdowns around the world. That being said, the Ethereum market is a little bit different, in the sense that it seems to have quite a bit of network utility, but at this point you have to keep in mind that most of the crypto markets tend to move in the same general direction, so the fact that Bitcoin sold off so drastically has had an effect on this market.

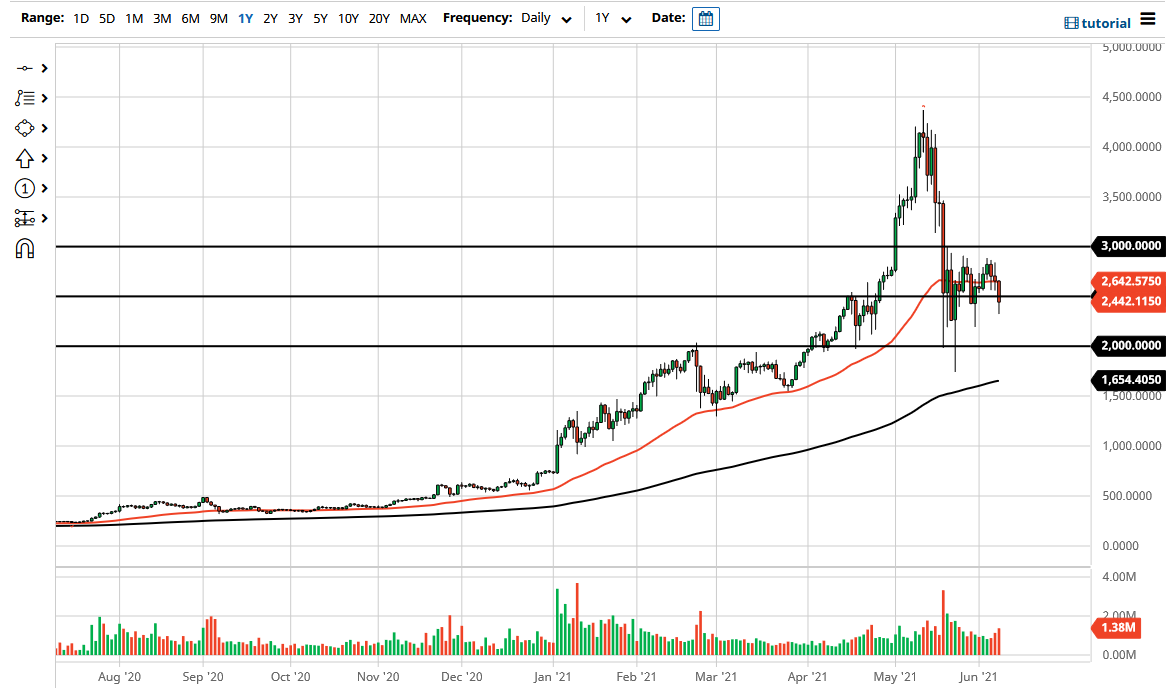

The technical analysis for this pair is very indecisive, as the 50-day EMA has gone very flat, sitting at roughly $2650. I do believe that the market will eventually try to find its longer-term direction, but right now it seems as if the overall attitude of the market is going to continue to go between $2000 on the bottom and the $3000 level on the top. As a result, the $2500 level essentially makes a “fair value price” for the market. It acts as a magnet for price, and with that being the case I believe that it is only a matter of time before we have to make a bigger decision, but right now I think there will be a bit of grinding as we try to figure out where we are going next.

It should be noted that the market has recovered a bit after selling off during the day, so it does suggest that perhaps even though we recovered somewhat, the reality is that it certainly looks as if there is more pressure to the downside than up. The volume picked up during the day due to the selling pressure, and the market is probably going to continue to see people jumping in to reach down towards the $2000 level. If we break down below there, then we will see the market break down below that area and the 200-day EMA. If that happens, it could be very negative for the market and it could absolutely fall apart. On the other hand, if we could turn around and break above the 30,000 level, then the uptrend would continue. Unfortunately, Bitcoin will have a large and rather outsized influence on what happens next.