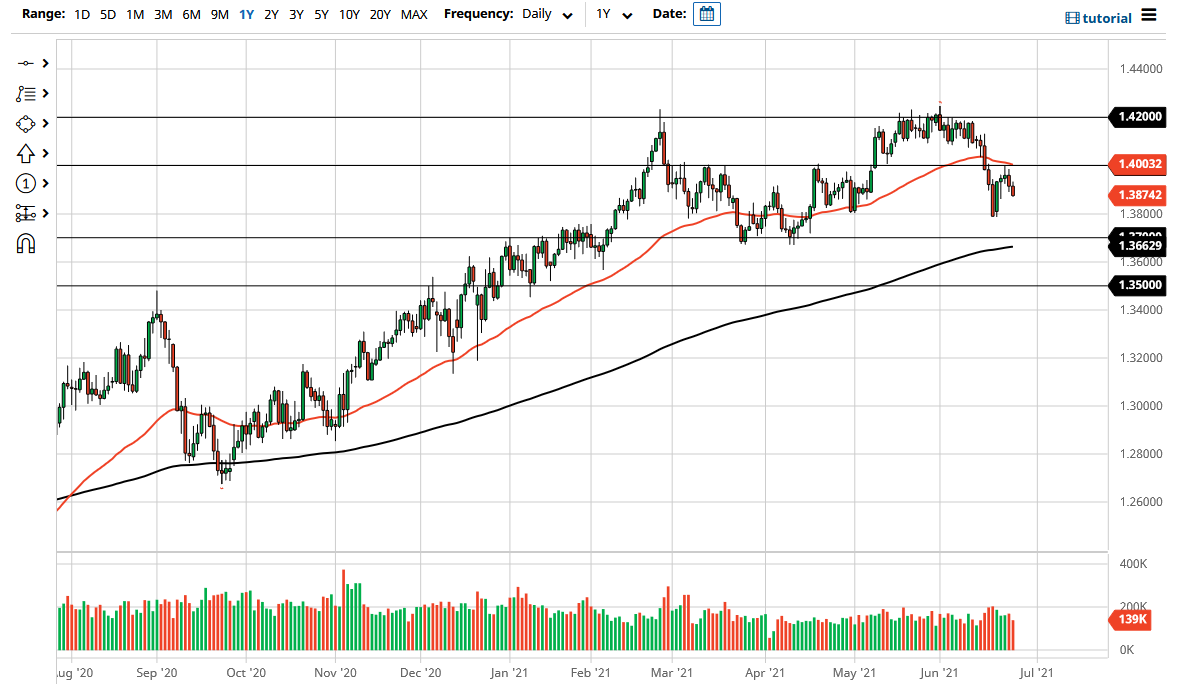

The British pound fell a bit during the trading session on Friday, as we began to see weakness heading into the weekend. The market is below the 1.39 level, and now looks as if it is going to reach towards the 1.38 handle. Breaking down below that level then opens up the possibility of a move down to the 1.37 level where we start to wrestle with the idea of the 200-day EMA underneath.

To the upside, the 1.40 level should continue to offer resistance, so I think at this point what we are seeing is the market trying to form some type of range, as the market continues to be very noisy to say the least. After all, the Federal Reserve is a bit confused at the moment, as they have given mixed signals when it comes to tightening monetary policy, and that has the markets on edge. If the Federal Reserve does in fact tighten, or if we start to see a major shift in strength in favor of America, that will probably send this market much lower.

If the Biden administration gets its infrastructure bill, traders may start to focus on the US dollar in reaction to that type of bullish scenario. At this point in time, it is worth noting that the market has struggled to overcome the 1.42 handle, an area that has been important more than once. Because of this, I think we are likely to hear a lot of noise more than anything else, but if we break down below the 200-day EMA, it is likely that this thing will fall apart and we will looking towards much lower levels.

Expect volatility, and make sure that you keep your position size reasonable, as we may see sudden turnarounds in both directions. What we see here is an opportunity for small positions, adding to them as we get a bit more clarity. If this is in fact going to be some type of major breakdown, I think you could probably get rather aggressive, because that would be a sign of serious problems. I believe that the next couple of weeks ago will be crucial for the US dollar, so it is definitely worth watching the US Dollar Index as well.