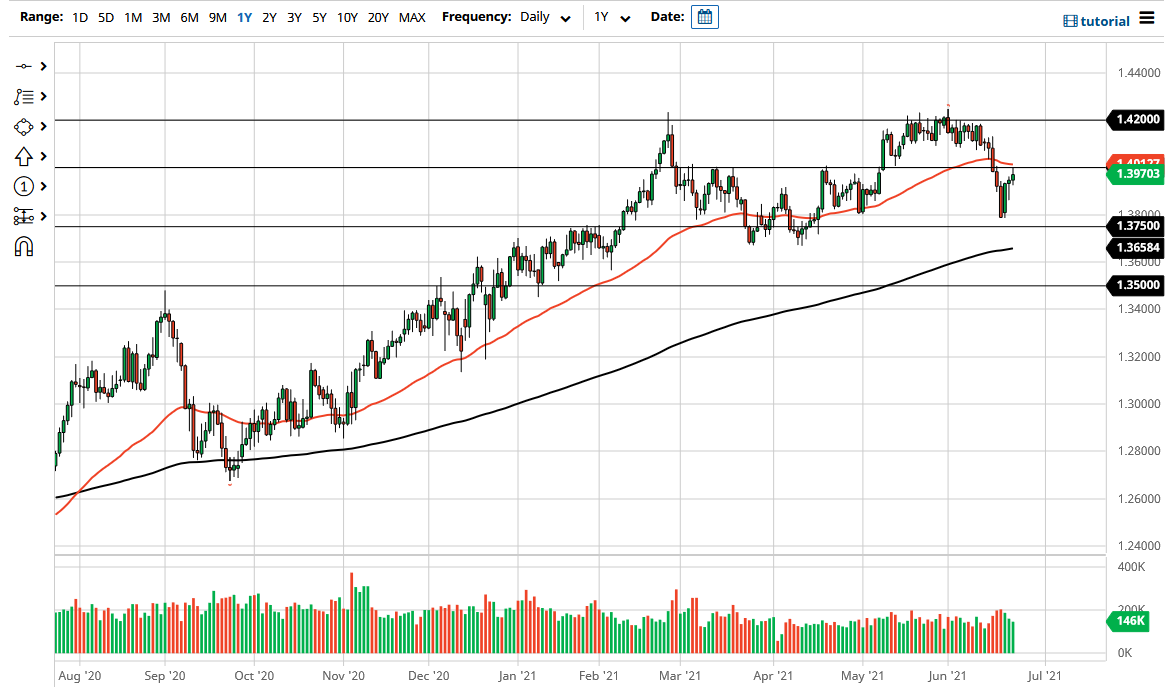

The British pound rallied a bit during the trading session on Wednesday to reach towards the 1.40 handle above and the 50-day EMA as well. Looking at this chart, it looks very likely that the 1.40 handle will matter, so breaking above there would be very bullish and could send this market looking towards the 1.42 handle.

To the downside, the fact that we have pulled back a bit from the 1.4 level shows just how negative this market could be with just a simple push. If we do pull back, then it is likely that we are going to go looking towards the lows again near the 1.38 handle underneath. I think that this market may be trying to carve out a summertime range, using the 1.37 level on the bottom as a bit of a “floor”, while the 1.42 level would be the ceiling. The 1.42 level has been crucial for some time in this market, so it is not a huge surprise that we have seen a little bit of a pullback from there.

The US dollar will be a major influence on this pair, as we have seen a lot of questions about tightening and the like coming out of the Federal Reserve. They have walked back a little bit of the hawkish talk over the last week or so, so it does make sense that the British pound would probably rally just a bit as the US dollar fell. Furthermore, we have to keep in mind that the British economy will eventually wake up and open up. If and when that happens, then we could see the British pound try to take out the 1.42 handle, but the chart right now tells me that we are probably going to see more choppiness around the 1.40 handle than anything else. If this does in fact end up forming a bit of “fair value”, then it obviously means that the range may very well start to be calculated in, setting up that potential situation for the summer, which does tend to be somewhat range-bound to begin with. At this point, the Federal Reserve has walked back a lot of that hawkish talk, so now the market is basically back to where it was just a few weeks ago.