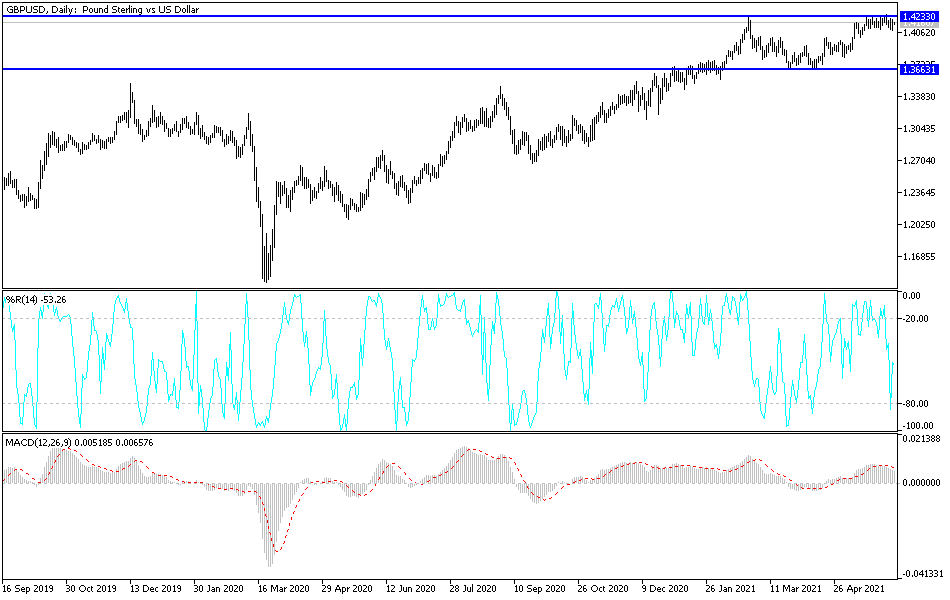

The British pound shot higher during the trading session on Friday to reach towards the 1.42 handle again. By doing so, we have tested the same resistance barrier that we have been working against for a while now, and this just tells me yet again how important this level is going to be. If we can break above the recent highs from earlier this week, then I think that the market probably has a real shot at reaching towards the 1.45 handle. That being said, it is not necessarily going to be easy to get there, but clearly, we are knocking on the door.

Looking at this chart, there is obvious support underneath near the 1.40 handle where the 50-day EMA is coming into the picture. That is an area that is not only a large, round, psychologically significant figure, but it is also an area where we have seen quite a bit of resistance previously. With that in mind, I think that we are looking at a scenario in which the British pound is going to be more of a “buy on the dip” scenario, especially as we continue to see a lot of loosening coming out of the Federal Reserve. That is part of what made the market shoot straight up in the air, as the narrative of the Federal Reserve tapering took a little bit of a hit.

Nonetheless, it is obvious that we are going to continue to struggle to get above, but if we do eventually get some type of daily break out and, more importantly, a close on the daily candlestick to show conviction, then I think we will see a rush of money into the market. On the other hand, if we were to break down below the 1.40 level, then it is likely that we could go down towards the support level right around the 1.38 handle. That being said, I do not really have an interest in shorting this market, but I recognize that you do not necessarily want to jump in and buy it here either. I need some conviction in the form of a strong daily candlestick in order to get long, but clearly that is probably not going to happen sooner or later the way we have been picking away at this barrier.