There are weakness factors that may negatively affect the performance of the sterling against the rest of the other major currencies. This is led by the postponement of the date of freedom in Britain with the increase in infections with the Corona Delta variable, in addition to severe skirmishes between Britain and the European Union. During the last week's trading and for a very short time, the price of the GBP/USD currency pair moved towards the 1.4000 psychological resistance, but these mentioned factors contributed quickly to the currency pair's decline to the support level 1.3873 at the end of the week's trading. The UK has recorded the largest number of new coronavirus infections since early February, even as the National Health Service implemented a "grab jab" initiative to increase vaccination rates.

Government figures earlier this week showed another 18,270 people had tested positive for the virus across the UK, the highest daily number since February 5. Nearly 100,000 people have tested positive for the virus over the past week. This was an increase of nearly 50% compared to the previous week, and it has raised questions about whether the lockdown restrictions will end as planned.

The latest surge came with the opening of hundreds of vaccination sites including in stadiums and shopping centers in England over the weekend. It is an attempt to increase the number of vaccines, especially among the younger age groups.

“The British pound suffered against the US dollar, as was feared, by the lack of a hawkish tone from the BoE at the end of the MPC meeting,” says Roberto Mialic, Forex expert at UniCredit. In turn, the bank has made it clear that it will not tighten until it sees clear evidence of progress toward its goal. Although it acknowledged that the downside risks to the British economy have been reduced.”

The British pound was sold off after the optimistic Bank of England did not meet the high expectations that had been built up by investors ahead of the June policy meeting. The bank showed it was in no rush to raise interest rates with the statement released after the meeting revealing that policy makers see the current rise in inflation as temporary. This is a potentially disappointing outcome for those in the currency market looking for more urgency. All members of the Bank's Monetary Policy Committee (MPC) chose to keep rates unchanged, but one member - Andy Haldane - voted to reduce the size of quantitative easing by 50 billion pounds.

The absence of any other members joining Haldane indicates that the MPC is not in a mood to present the outlook for tightening, which could be a source of disappointment for those who have been put in a position to appreciate the pound. Economists at the bank have revised their forecasts for the level of UK GDP in the second quarter of 2021 by about 1.5% since the May report, as restrictions on economic activity ease, and output in June is expected to be about 2.5% lower than pre-Covid-19.

Despite any optimism about the outlook, the MPC does not appear to be in the mood to raise interest rates. The bank stated that they see the delay in the final lifting of all restrictions imposed on the Corona virus, which was originally scheduled for June 21, to have little impact on the economic outlook. On inflation, the MPC expects that the direct impact of higher commodity prices on CPI inflation will be transient, a view that effectively revives any optimistic economic assessments seen elsewhere in the June policy update.

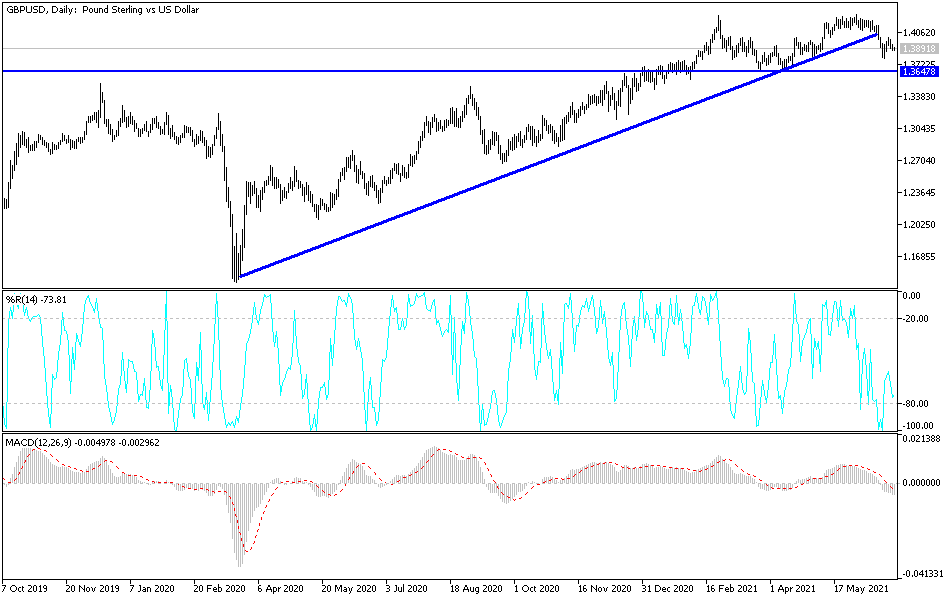

GBP/USD technical analysis: The bears' control over the performance of the GBP/USD currency pair is getting stronger with the pair's failure to breach the 1.4000 psychological resistance again. The intensification of the above-mentioned factors will push the bears in the currency pair towards lower levels, and the closest ones are currently 1.3865, 1.3770 and 1.3690, respectively. On the other hand, the currency pair will return to its ascending path if the resistance level 1.4085 is breached. The sterling will react today to new comments from Bank of England monetary policy member Haldane, as the markets are looking for signs of tightening the bank's policy.