The sharp strength of the US dollar in interaction with the bank's statement, and the statements of its governor contributed to pushing the price of gold towards the support level of $ 1767 an ounce, its lowest level in seven weeks. Before the bank’s issuance, the price of gold was on the threshold of psychological resistance of $1900 an ounce. During the week, the price of gold fell by 5 percent, and since the beginning of trading in the year 2021 to date, the price of gold has declined by more than 5 percent.

As for silver, the sister commodity to gold, it fell even further. Silver futures fell to $26.615 an ounce. Accordingly, the price of the white metal fell by 5% this week, but it remained up by about 0.4% over the year 2021.

This week, the Federal Reserve completed its two-day FOMC policy meeting. While keeping benchmark interest rates unchanged at 0.25%, US monetary policy makers have indicated that they may trigger a rate hike sooner. The bitmap shows that two interest increases could come in 2023, one year earlier than previously expected.

A high interest rate environment is harmful to non-yielding bullion because it raises the opportunity cost of holding precious metals.

The Federal Open Market Committee also expects inflation to rise this year and in 2022. The committee seeks to maximize US employment and inflation at a rate of 2% over the long term. With inflation remaining below this long-term target, the committee will aim for moderate inflation above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain at 2 percent.

All in all, this was a hawkish tone that upset global financial markets, as major stock indexes extended losses at the end of the trading week. On the other hand, the US Dollar Index (DXY) rose 0.73% to 91.79, from an opening at 91.13. A stronger dollar gain is bad for dollar-priced commodities such as gold, because it makes them more expensive to buy for foreign investors. We noticed a contrast in the performance of the US bond market, where the yield on the 10-year Treasury bond increased by 0.003% to 1.572%. Yields on one-year notes fell 0.013% to 0.071%, while yields on 30-year notes rose 0.032% to 2.177%.

In other metals markets, copper futures for July fell to $4.294 a pound. Platinum futures fell to $1,105.20 an ounce. Palladium futures collapsed to $2,753.00.

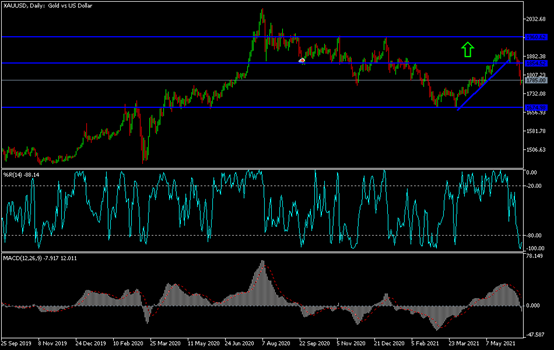

Gold technical analysis: The recent selling operations pushed some technical indicators to strong oversold levels. We expect a return to buying gold from the support levels 1775, 1760 and 1745, respectively, waiting for the moment of the rebound higher. The markets have almost finished pricing what happened from the US central bank and will then start interacting with the course of the Corona virus and the improvement in the performance of the global economy. Any new global geopolitical tensions to play its role as a safe haven. The return of the bullish trend for gold depends on penetrating the resistance of 1855 countries again.