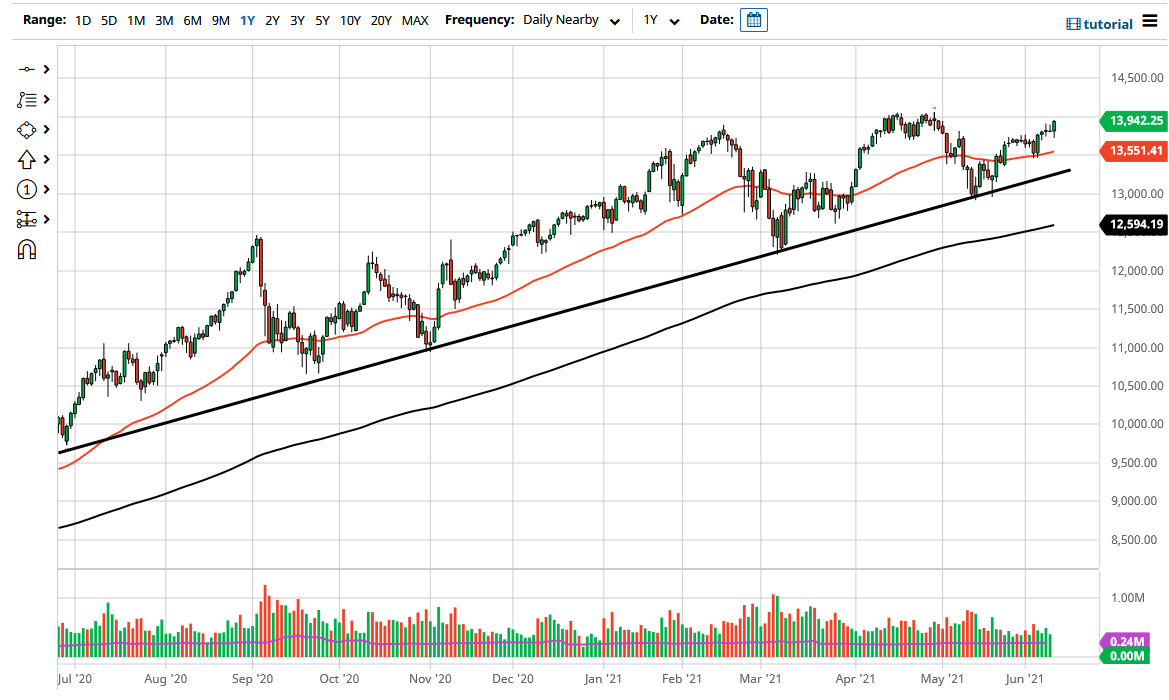

The NASDAQ 100 initially pulled back during the trading session on Thursday as traders got concerned about the upcoming CPI number. The number was higher than anticipated, but at the end of the day the traders started buying things out, as interest rates did not spike the way they had been concerned about. The market is closer to the top of the candlestick and that is a very bullish sign. The 14,000 level is an area where we have seen a lot of resistance recently, and just below the overall all-time highs.

That being said, the market is likely to continue to see buying pressure and I do think that we break out sooner rather than later. Whether or not we do it heading into the weekend might be a completely different question though, because there does seem to be a bit of a proclivity on Friday for a bit of profit-taking. Regardless, I have no interest in shorting this market because it is so obviously bullish, and of course we have the 50 day EMA underneath turning higher at the 13,500 level, which of course is the next major figure.

That being said, once worth paying attention to is the fact that we have broken above the top of the last two shooting stars, and we have busted through a significant amount of short-term noise. We are in an uptrend, and you could even make an argument that we are in an ascending triangle. With that being the case, if the market does break out of believe that the measured move probably send this market looking towards the 14,500 level, possibly even the 15,000 level.

As long as interest rates can stay mild, then it is likely that we will see NASDAQ continue to see a certain amount of strength due to the fact that technology stocks tend to do better in a low interest rate environment. The fact that the interest rate markets do not seem to be overly concerned suggests that we will have more of the same going forward as we have over the last several months. With this, I like short-term dips as buying opportunities, keeping an eye on a potential break out coming later. All things been equal, there is not even a scenario where I would consider shorting.