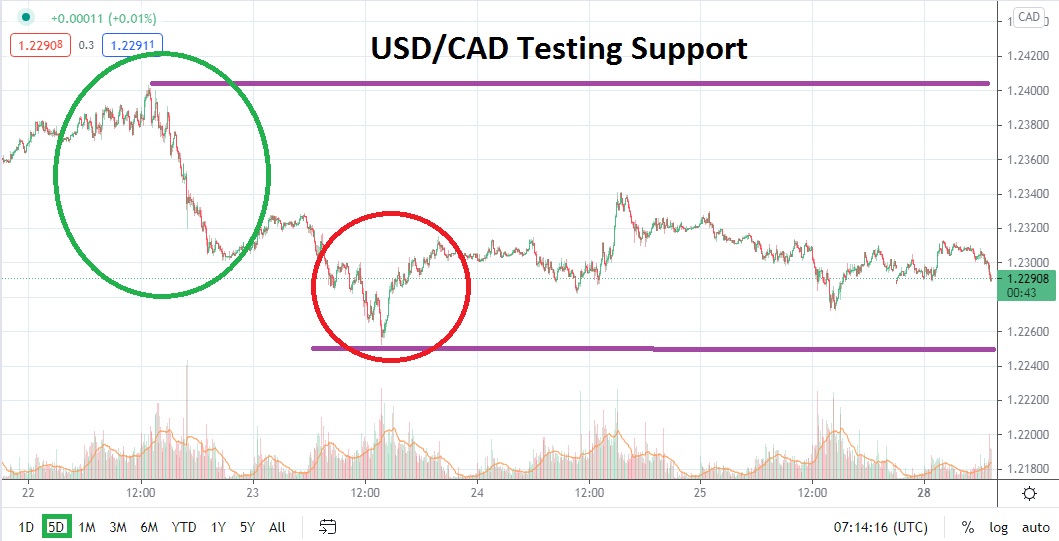

As of this writing, the USD/CAD is trading near the 1.22900 ratio, and this is significant because if the 1.23000 juncture is able to provide durable resistance near term, this might indicate that further bearish momentum will develop. After reaching a high of nearly 1.24870 on the 21st of June, the USD/CAD has begun to move lower and penetrate support levels.

On the 1st of June, the USD/CAD was trading near the 1.20060 mark. Prior to this, the last time the USD/CAD was able to trade at such depths was in May of 2015. Short-term traders might have felt blindsided by the sudden emergence of bullish momentum in early June which saw the highs on the 21st of the month exhibited, but in reality, a reversal higher may have been part of the natural cycles which Forex often demonstrates.

Intriguingly, the high of 1.24870 was not able to be sustained with any dynamic force and the USD/CAD has clearly shown an inclination to move lower. The USD/CAD has provided speculators with plenty of price velocity the past four weeks of trading. The volatility has had a lot to do with the low in early June being seen, but also was influenced by the pronouncements of the U.S Federal Reserve, which certainly caused nervousness within financial institutions.

The current resistance juncture of 1.23000 is appealing because it serves as a psychological barometer regarding behavioral sentiment for traders to observe. If this level can withstand moves higher in the coming hours and next day, it could be a rather important indicator that the USD/CAD has further room to traverse lower.

While support around the 1.22860 level appears important, traders should keep their eyes on values below too. If the 1.22660 mark begins to be tested this would be a rather interesting juncture, because below this value the 1.22500 ratio looks to be a viable inflection point. Taking into consideration the swift moves the USD/CAD has made recently, traders need to have their risk management working to guard against tumultuous results.

Cautious traders may be inclined to sell the USD/CAD after slight reversals higher have been made. Using appropriate entry points above current market values and aiming for cautious support levels which are nearby could produce profitable results. The USD/CAD appears ready to demonstrate another round of volatility and speculators should monitor the Forex pair carefully.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.23010

Current Support: 1.22860

High Target: 1.23150

Low Target: 1.22560