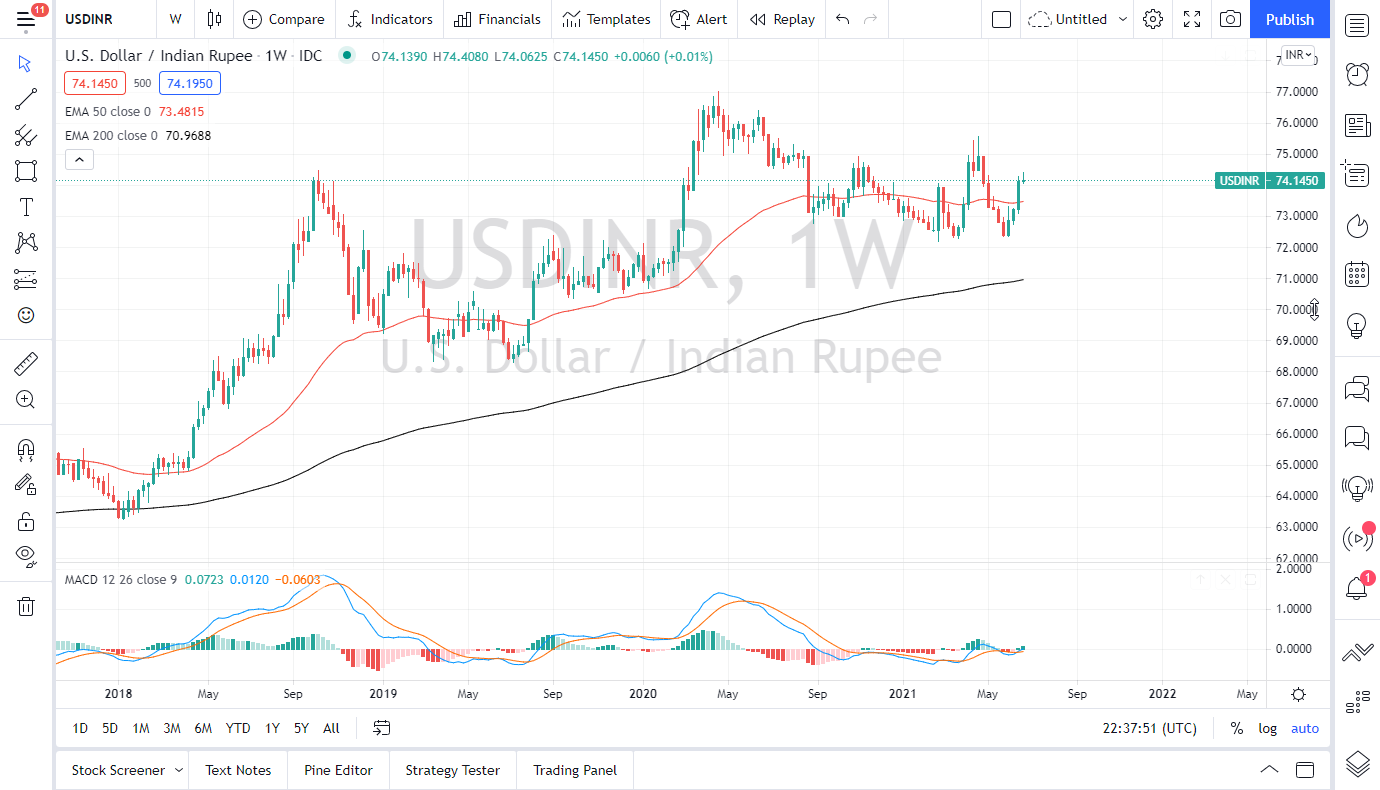

The US dollar has spent the last month or so rallying against the Indian rupee, but it certainly looks as if we are starting to run into a bit of exhaustion near the ₹74.50 level, an area that begins resistance all the way to the ₹75 level. When you look at the last several months, you can see that we have been carving out a consolidation area just above the ₹72 level and just below the ₹75 level. This is a market that stays within that range, so the month of July could be a little bit soft.

However, if we were to break above the ₹75.50 level, then the market will more than likely go looking towards the ₹77 level above, which was the recent high. Ultimately, I do think that if we get a bit of negativity in the risk appetite around the world, that will probably send this market straight up to that level. Breaking above that would obviously be an extraordinarily “risk off” type of move.

To the downside, in what looks to be the easiest move, it is very likely that traders will be looking to reach down towards the ₹72.50 level, which has already proven itself to be supportive a couple of times. If you are going to trade emerging market currencies such as Indian rupee, you are probably going to have to pay close attention to certain things such as the US bond market, because if interest rates suddenly start hiking, that could bring more money into the US dollar, as the yield would be attractive. However, there is the exact opposite effect as well, as the bond yields crashing could also be a sign that people are buying bonds hand over fist to get away from risk, so at this point, what you want to see is stabilizing yields in the bond market. In other words, the quieter the bond market is, the more likely people are going to be willing to step in to emerging markets and currencies such as the Indian rupee, Mexican peso, Indonesian rupiah, etc. Pay close attention to those two major levels, because they should lead the way as to where we go not only for the month of July, but perhaps the rest of the summer.