Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken before 5pm Tokyo time Friday.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 111.31 or 111.50.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 110.55 or 110.16.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

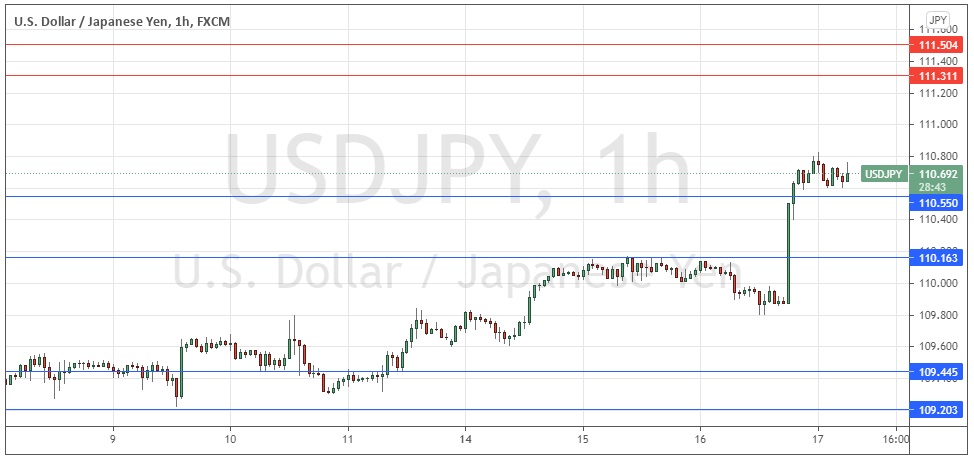

USD/JPY Analysis

I see the USD/JPY currency pair as having suddenly become much more interesting to traders, as it broke strongly to a new 50-day high price yesterday on well above-average volatility. This suggests that the price is likely to rise higher over the coming days. The strong boost to the USD was caused by the U.S. Federal Reserve upping its inflation and rate hike forecasts, for several debatable reasons. Meanwhile, the Japanese yen maintains its position as the major currency with the greatest long-term weakness, so we seem to have a “perfect storm” for USD/JPY bulls to exploit.

Technically, we see a new higher support level printed at 110.55, and the price seems to be consolidating bullishly just above that level. The short-term price action is bullish, so we have both long-term and short-term indications that a further rise is likely over the coming days. This currency pair, along with the EUR/USD, tends to trend very reliably, so traders should get interested in taking a long position in this currency pair if possible.

One note of caution for bulls – a potentially inflective 1-year high price is not far away, at 110.97, confluent with the round number at 111.00. This means that there could well be a bearish reversal if the price reaches that area. On the other hand, a daily close above 111.00 would be a very bullish sign and could then be the start of an extended bullish directional move through “blue sky”.

I take a bullish bias on the USD/JPY currency pair and already entered a long trade at 110.67 yesterday. I would be very happy, if I did not have this trade open, to enter a long trade from any bullish bounce at 110.55 or even one of the lower support levels identified above. There is nothing of high importance due today regarding either the JPY or the USD.

There is nothing of high importance due today regarding either the JPY or the USD.