Last Thursday’s AUD/USD signals were not triggered, as there was insufficiently bullish price action when the support level identified at 0.7367 was first reached.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered prior to 5pm Tokyo time Wednesday.

Short Trade Ideas

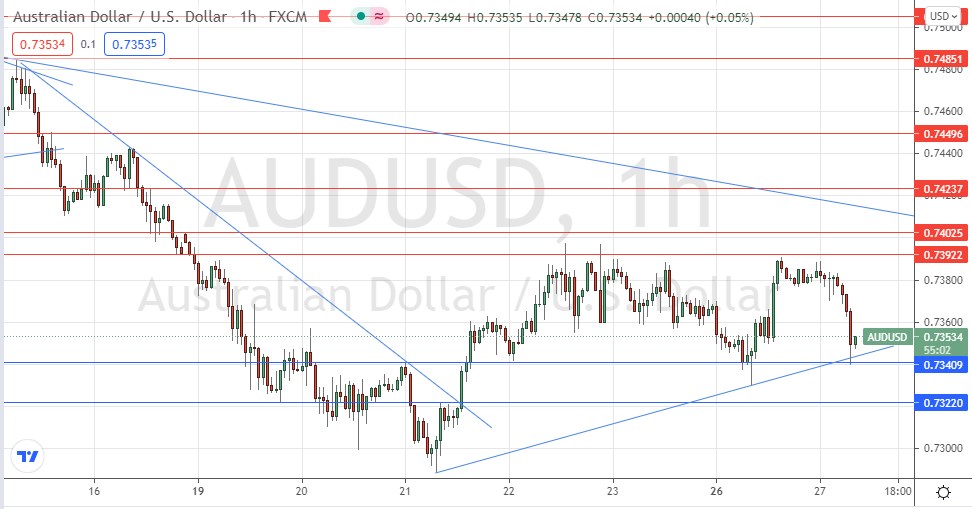

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7392, 0.7403, 0.7424, or 0.7450.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Long entry following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 0.7341 or 0.7322.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Thursday that there was technical evidence of strong short-term bullishness in strong bullish candlesticks and the clear and clean break above the former bearish trend line shown within the price chart below. I thought this could be good for a short-term long trade.

The price did not fall over the day, so this was not a damaging call, but the technical picture has turned bearish again, although technically we are seeing the price chart below dominated by a narrowing triangle formation. However, this should be taken as bearish.

The main bearish feature is the persistent failure to rise above 0.7400 and the printing of several distributive tops very close to that level.

The Australian dollar is one of the weakest major currencies at present due to the impact of continuing coronavirus lockdowns in Australia and the very low inoculation rate which seems to necessitate such restrictions. We have already seen a major weakening in retail sales data. Added to this, the RBA has been signalling that QE is not going to end any time soon.

We have a bearish picture but at the time of writing, the price is sitting at a supportive confluence of the lower ascending trend line of the price triangle and horizontal support at 0.7341 which it may not be able to break down.

I do not want to take any long trades in this currency pair today, and I will instead take a bearish bias if we get two consecutive hourly closes below 0.7322, or a bearish reversal at 0.7392 following a retracement to that resistance level.

Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm London time.

Concerning the AUD, there will be a release of CPI (inflation) data today at 2:30am.