Bullish View

Buy the BTC/USD and add a take-profit at 34,000.

Add a stop-loss at 30,000.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 30,000 and a take profit at 28,000.

Add a stop-loss at 31,000.

The BTC/USD price held steady above $31,000 as investors focused on the B Conference that features some of the most prominent individuals in the industry. Bitcoin rose to $32,920, which was substantially higher than this week’s low of $29,340.

Elon Musk Helps Push Bitcoin Higher

The Bitcoin price crashed sharply on Monday as fear about the Delta variant rose. The Fear and Greed Index, which is a popular gauge, declined to the lowest level in months. At the same time, the main stock indices like the FTSE 100 and the Dow Jones declined by more than 1.50%. This happened as countries reported more Delta variant cases, with some adding new restrictions.

The BTC/USD made a strong recovery as the other assets rose. In the past three days, the coin has risen by more than 9%. Stock indices like the Dow Jones and the S&P 500 have also jumped by more than 1.8% in the past two days. These gains have also been driven by the relatively strong corporate earnings.

Bitcoin was also supercharged by the ongoing B Word online conference that featured some prominent speakers like Elon Musk, Jack Dorsey and Cathie Wood. In the conference, Elon Musk said that he was still a believer in Bitcoin. He reiterated that his companies, Tesla and SpaceX owned some coins. He also said that he personally owned the coin in addition to Ethereum and Dogecoin.

Most importantly, he said that Tesla would likely start accepting the coin. After starting to accept Bitcoin early this year, the company reversed course citing environmental concerns. He reiterated that the firm would accept the coins when there is evidence that 50% of it is mined using clean energy.

BTC/USD Forecast

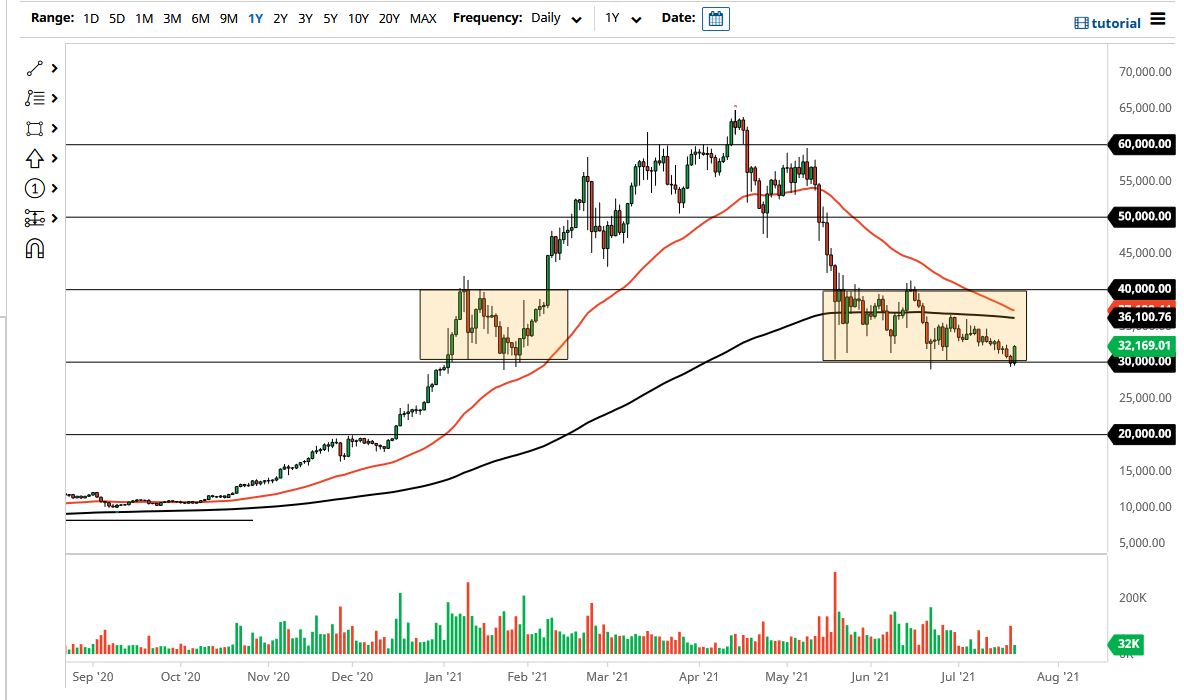

The four-hour chart shows the BTC/USD has been in an overall bearish trend in the past few months. Along the way, the coin formed a descending channel shown in black. As the coin declined this week, the price managed to test the lower side of this channel.

Today, it has moved slightly above the 50-day moving average while the Relative Strength Index (RSI) has moved close to the overbought level of 60. Similarly, the two lines and histogram of the MACD have moved slightly above the neutral line. Therefore, since the pair has moved above the upper line of the channel, there is a likelihood that the price will keep rising as bulls target the resistance at $34,000.