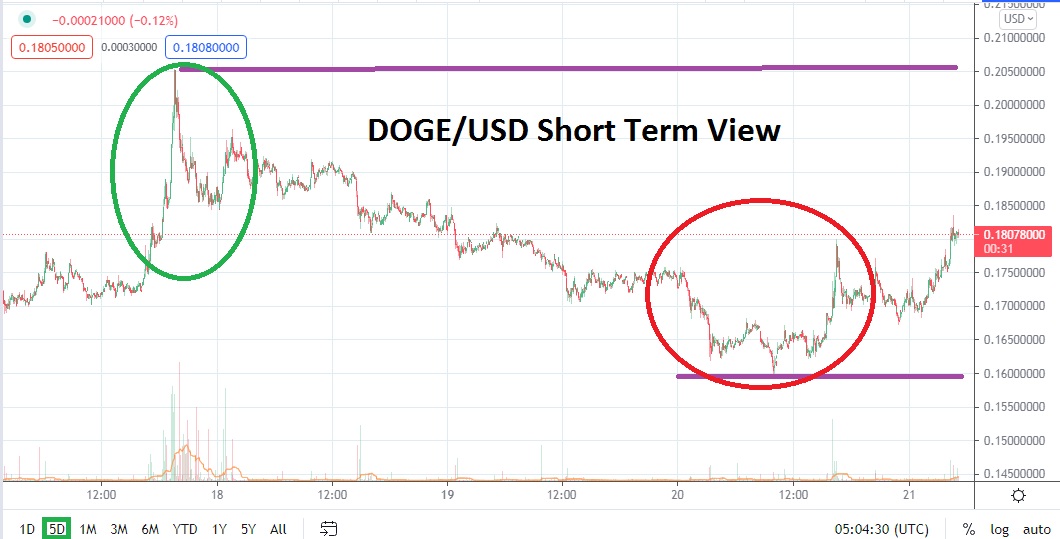

DOGE/USD, as of this writing, is near 18 cents, and this value has been accomplished with a slight reversal higher after Dogecoin played with the 16 cents mark yesterday. The reversal higher may look rather good when defined with a percentage move, but it doesn’t mask the notion that DOGE/USD has been within the grips of a serious decline, and incrementally continues to see resistance levels actually lower.

Cryptocurrencies certainly offer traders the prospect of large cyclical moves which can be technically defined by rather definitive trends. While bullish speculators may be wishing for a momentous move higher which begins to brush aside resistance levels once again, until DOGE/USD is able to sustain a solid week or two of upside direction, traders may cling to their nervous sentiment.

Technically, this nervous sentiment is generating two things within the broad cryptocurrency market. The first thing that is clearly noticeable and easy to attain information on is that there has been a dramatic drop in transactions the past couple of months, meaning trading volumes are low. This certainly has had an effect on point number two, and technically buyers seem to be indicating they do not want to step into DOGE/USD with a dramatic display quite yet. While the rise in value after falling to mid-term lows yesterday was a positive development, the lack of velocity upwards remains troubling.

The 18 cents juncture should be watched carefully today; if this level continues to be challenged and DOGE/USD stays within sight of support levels below, this is not a positive indicator. Bearish sentiment technically within Dogecoin remains evident and any moves upward which prove short-lived may actually be additional selling opportunities. Speculators who are willing to wager on downside momentum may be questioning just how much further DOGE/USD can fall. Traders should not be overly ambitious with their price targets, but aiming for lower terrain could be the logical choice.

DOGE/USD remains highly volatile. The small amounts of value measured with mere cents equates into moves of 10% and more quite easily for Dogecoin. Conservative amounts of leverage are urged and risk-taking tactics need to include stop losses. While DOGE/USD remains within a bearish trend, the cryptocurrency certainly has the capability to reverse higher again. However, from a risk/reward framework, it appears that nervous sentiment and poor technical signals may combine to create more downside pressure for DOGE/USD.

Dogecoin Short-Term Outlook:

Current Resistance: 0.18770000

Current Support: 0.17550000

High Target: 0.20100000

Low Target: 0.15550000