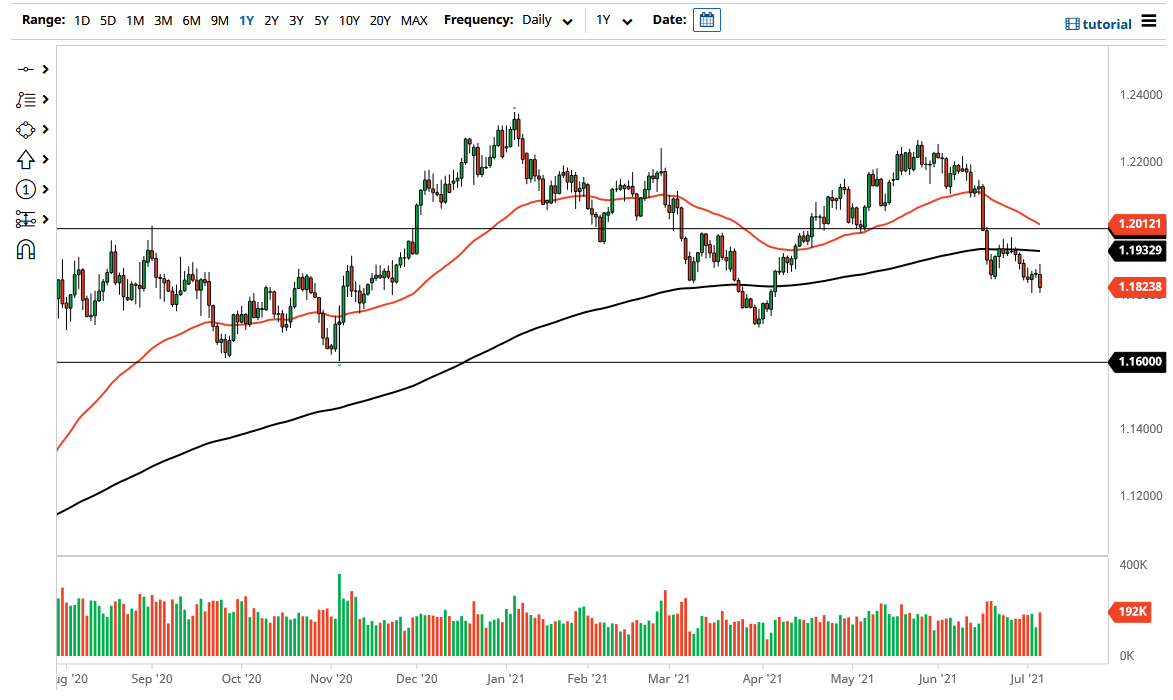

The euro initially rallied during the trading session on Tuesday but then turned around to show signs of weakness again. In fact, we fell enough to threaten the hammer from the Friday session, so if that support level gets broken down below, it is very likely that we could go looking towards the 1.17 level, followed by the 1.16 level after that. If that does in fact happen, I believe that we could see an acceleration in the US dollar against multiple currencies, not just the euro. Furthermore, the market will continue to see more of a “risk off” type of situation if that is the case, so it becomes a bit of a self-fulfilling prophecy.

To the upside, the 200-day EMA sits at the 1.1933 handle, which will offer a significant amount of resistance. Furthermore, the 50-day EMA is reaching towards the 1.20 handle, which in and of itself is important. With the 50-day EMA walking right along that path, I think it is only a matter of time before the sellers would come in and take that on as a potential selling opportunity. Regardless, I think that the market is going to continue to see the most likely path forward as selling short-term rallies, with an eye on choppy behavior more than anything else. After all, there are a lot of concerns out there when it comes to inflation and the idea of growth in general, which will have a major effect on where we go next. At this point in time, it seems as if we are at a bit of an inflection point, and it looks a bit negative at this point.

We could get a turnaround of course, but ultimately the market is going to need some type of catalyst to make that happen. I do not see that as being the case, so this is a market that I think will continue to see volatility pick up more than anything else, as we are seeing in multiple markets, not just this one. You should also pay close attention to the bond markets, because they have definitely attracted a lot of capital during the session as well, which by extension means that the US dollar will be in demand.