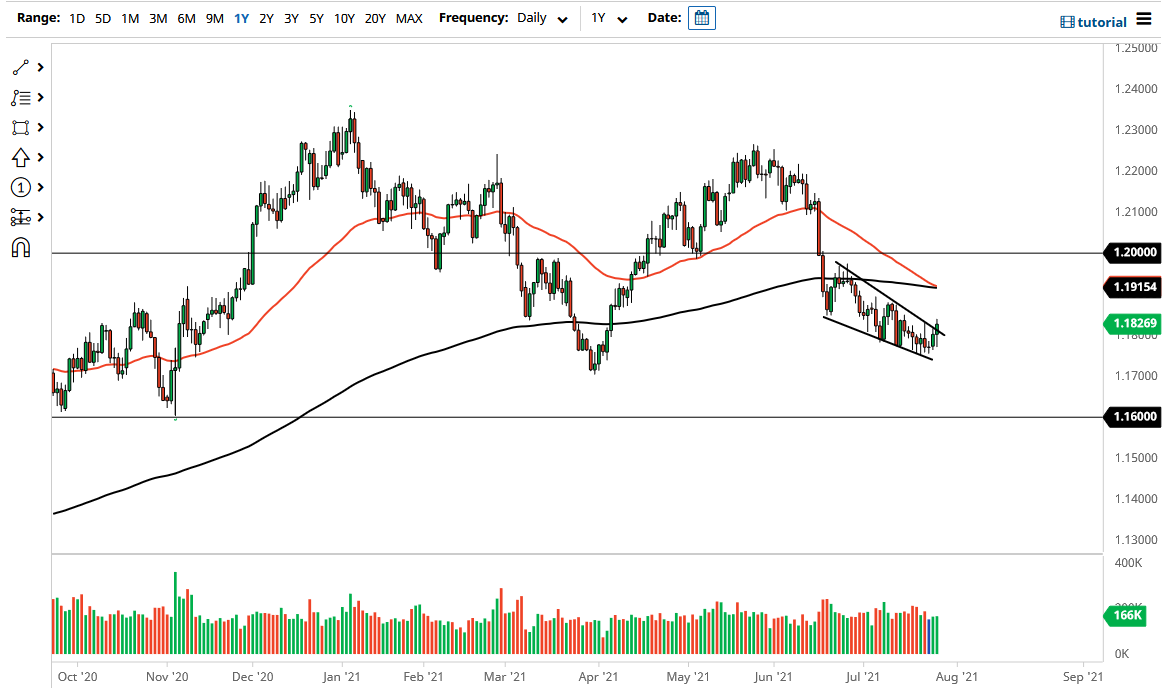

The euro initially fell during the trading session on Tuesday but then turned around to break above the top of the falling wedge that has been forming for quite some time. At this point, I think the market is simply trying to build up a bit of a trading opportunity ahead of the Federal Reserve statement. After all, the Federal Reserve will have a statement and decision at the end of the day on Wednesday which will have a great influence on the US dollar. That has a great influence here, due to the fact that the euro is considered to be the “anti-dollar.”

That being said, when you look at the market above, the 50-day EMA is getting ready to cross below the 200-day EMA, forming the so-called “death cross.” Because of that, a lot of longer-term traders will probably be looking to get involved, so I think it is only a matter of time before rallies get sold into. I would love to see some type of selloff after an initial surge higher, because it could give me an opportunity to take advantage of “cheap dollars.” However, it is also possible that the Federal Reserve will do something to shock the market and crush the greenback in general. If that is the case, the most obvious signal would be the 1.20 handle being overcome.

Keep in mind that there are a lot of issues out there that could have people running towards the bond market, which demands US dollars. With that, I think that the market will be very noisy once we get that announcement late during the day on Wednesday, but in the short term, it is likely that the markets will be very quiet. Furthermore, the pair has been very choppy recently, and I just do not see that changing anytime soon. The market has been grinding lower for a while, but I do not necessarily think that the move during the day on Tuesday was indicative of some other type of trend forming, especially as we have to worry about the global growth situation slowing down and the EU struggling with the Delta variant. Beyond that, the bond yield differential between Germany and the United States continues to see people wanting to put money to work in America.