It moved to the resistance level 1.1817 before settling around the 1.1795 level at the time of writing the analysis. We expect limited movements in narrow ranges for the currency pair until investors interact with the US Central Bank’s announcement tomorrow. The euro has weathered the recent market turmoil better than many other currencies, but it could see its resilience tested again this week by the Federal Reserve's announcement, which dominates the currency market calendar ahead of Friday's much-anticipated Eurozone GDP data for the quarter.

The single European currency remained elevated even as other countries came under pressure amid concerns about the impact of the new variables of the Corona virus on economies around the world. Commenting on the performance, Lee Hardman, a currency analyst at MUFG, said in a note on Friday, “Relationships with the other G10 currencies are declining. Until today, the euro has remained close to the 1.1800 level.” Hardman adds: “We expect the euro to continue declining against the US dollar encouraged by the Fed's discussions on reducing QE at tomorrow's FOMC meeting."

Hardman and the MUFG team noted last Friday that the euro's correlation with other major currencies was declining and noted that it had recently been trading like a "correlated currency." One factor that likely explains part of this is the euro's popularity as a "funding currency", which has caused it to be sold against the British pound, Australian and New Zealand dollars, Canadian dollars, and others throughout the year to date.

This is because for investors to close their previous bets on the currencies indicated above, they have to buy back the Euro. However, with this “funding currency” role tied to low interest rates in the eurozone, there is another aspect to them that could make the single European currency vulnerable again this week in case there are any suggestions from the Fed that it is nearing completion. The Fed indicated in June the markets have been speculating heavily since then that it might soon announce plans to end its quantitative easing program.

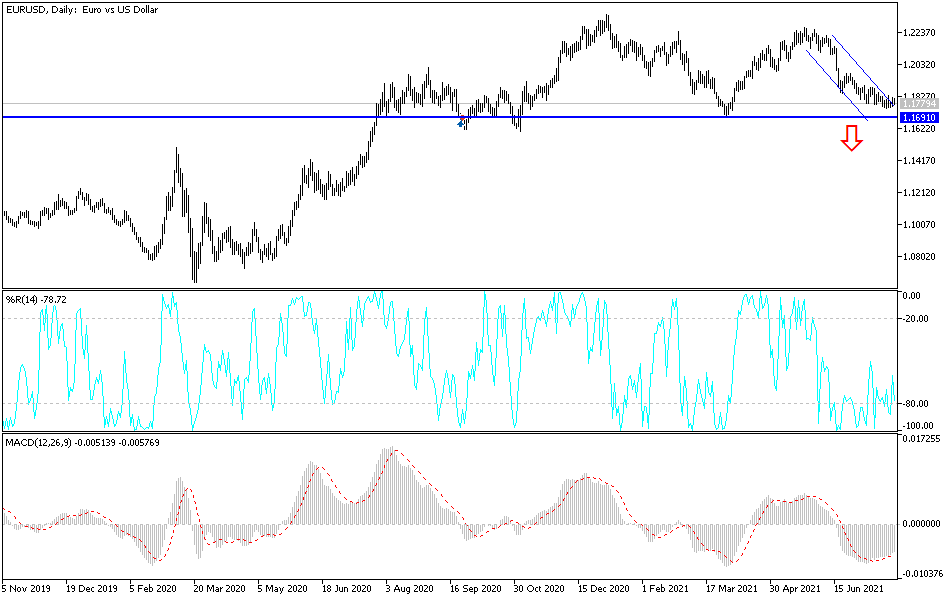

Commenting on the future of the euro-dollar, Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank says “The new marginal bottom has not been confirmed again by the daily RSI and we believe we will see a corrective bounce back to the 1.1860/1.1930 range. Below 1.1750 interest will return to the September, November and March lows at 1.1704/1.1600.”

According to the technical analysis of the pair: On the daily chart, the EUR/USD is still moving within its bearish channel, and there will be no actual breach of this trend without the bulls moving to the resistance levels 1.1888 and 1.2010. Otherwise, the general trend will remain bearish as it is now. Returning to the support levels 1.1760 and 1.1690 will strengthen the bears' control to move towards stronger support levels. At the same time, technical indicators moved to oversold levels.

As for today's economic calendar data: Eurozone money supply will be announced, then US durable goods orders and US consumer confidence readings.