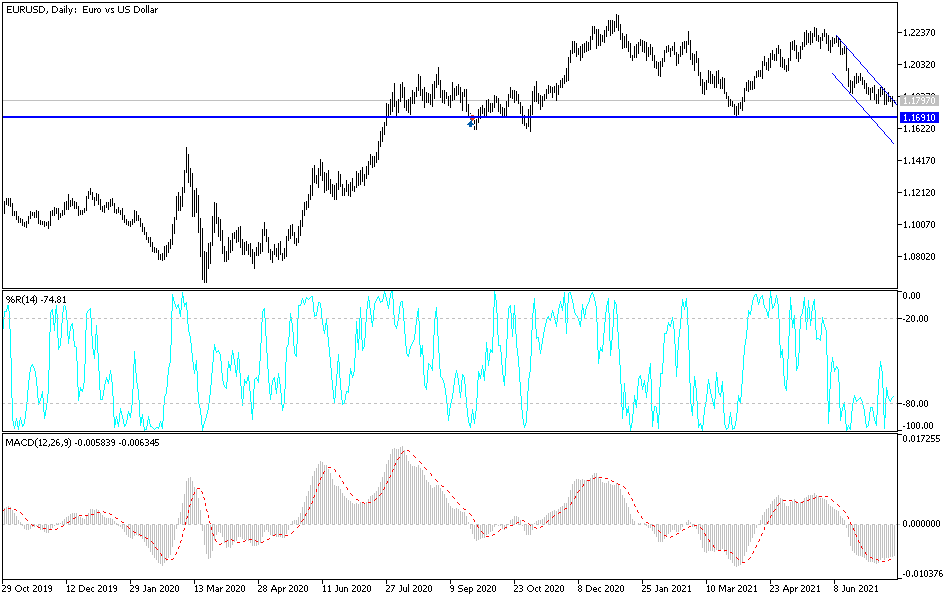

The price of the EUR/USD fell to the 1.1765 support level, its lowest in three months, before settling around the 1.1795 level. The euro may remain under current pressure until the ECB's monetary policy update this week. This event is pivotal whether the single European currency can sustain itself above the nearby support level at 1.1777, or succumb to further collapse. We noticed the continued resilience of the Euro in the face of a six-week advance by the US dollar in the forex market.

Overall, the Euro dropped below $1.18 four times in recent sessions only to attract bids from the market soon after, which encouraged chart watchers, some of whom were tempted to bet that the Euro might soon try to walk back towards the 1.19 handle. “The EUR/USD has so far held its 2020-2021 support line at 1.1777 on a closing basis,” says Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank. It is trying to stabilize, but will face stiff resistance at 1.1884/95, the highs from last week and 23.6% retracement. Currently, the Elliott wave count indicates that the rally is only corrective and is likely to end around 1.1940.”

Jones and the technical analysis team at Commerzbank bought EURUSD last week at 1.1836 and 1.1815. They were in favor of the bank's clients doing the same in anticipation of an attempt to recover the 1.19 level, although they also suggested short positions around 1.1880. However, the outlook for the EUR hangs in the balance, and whether it will hold above the recently tested support level at 1.1777 this week will likely depend on the ECB's decision on Thursday, the market's response to it and whether the dollar continues to rally.

"We look forward to a limited rally in the trade-weighted dollar this week," says Peter Karpata, chief strategist at ING. Not only is it a fairly quiet week on the US data front (indicating limited catalysts for a domestically driven dollar rally), but the ECB is likely to be cautious/pessimistic this week and could provide support for cyclical forex, which may also extend to the US dollar, and that although the EUR/USD pair will continue to decline.”

There is little in the way of key European or US economic data to guide the euro and dollar ahead of Thursday's 12:45 ECB policy decision and 13:30 press conference, although Friday morning sees the release of the month-long PMI survey results. July for the Eurozone Manufacturing and Services Sectors released by IHS Markit.

Commenting on the outlook for the ECB's decisions, Jack Allen-Reynolds, an economist at Capital Economics, said, “We don't expect any changes in its policy rates or the pace of asset purchases. Other than that, we think the PMIs may have risen more in July, which could indicate that the second-quarter recovery will continue into the third."

According to the technical analysis of the pair: On the daily chart, the EUR/USD test returns to the support level 1.1765, and below it will move the technical indicators to strong oversold levels. More penetration will push the currency pair to the support levels of 1.1710 and 1.1620, especially if the European Central Bank does not provide anything new to save the euro from further collapse. On the upside, the psychological resistance 1.2000 will remain the most important for the bulls to control performance and get out of the current sharp bearish channel.

As for the economic calendar data today: The German Producer Price Index and the Eurozone Current Account will be announced.