Last Monday’s GBP/USD signals were not triggered, as unfortunately the bullish bounce at the support level identified at 1.3817 did not happen until after 5pm London time.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today.

Short Trade Ideas

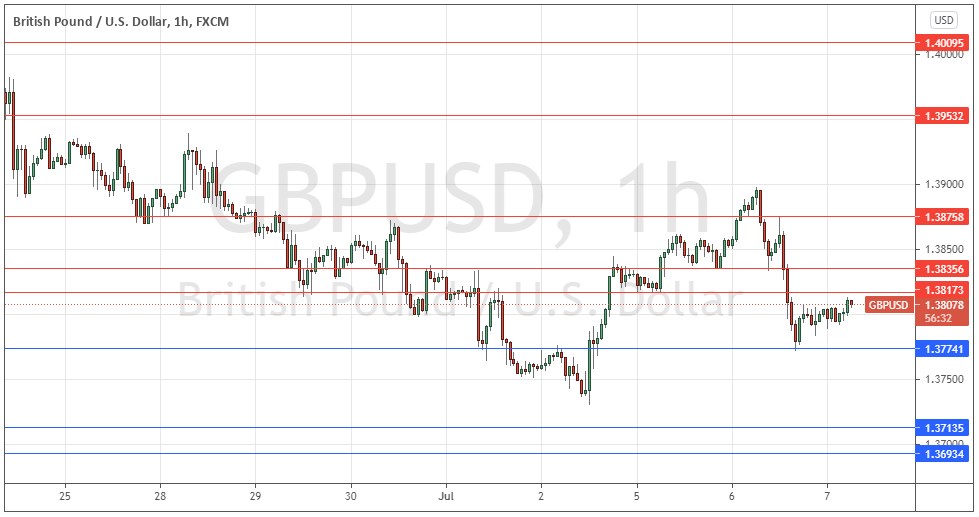

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3817, 1.3836, or 1.3876.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3774 or 1.3714.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Monday that it was hard to guess how much higher the price would go, against the long-term bearish trend. I thought that the key thing to watch was whether the support levels at 1.3817 and 1.3774 continued to hold. I was ready to take a bearish bias below 1.3774, targeting 1.3714.

This was a good call as the support at 1.3774 has continued to hold so my analysis was enough to keep away from any failing short trades.

There is a long-term bearish trend in this currency pair. We saw the dollar gain yesterday almost everywhere, but it is notable that the price here held up slightly better than most other currencies. Technically, it is important that 1.3774 held.

Price direction is very difficult to predict today because we are ahead of a major event in the Forex calendar – a release of US FOMC meeting minutes, which is quite likely to have a directional impact upon the price, which is again likely to consolidate ahead of the release. This means that the best approach here during today’s London session is likely to be scalping reversals for conservative profits either long or short at key levels. There is probably better potential for a scalp to turn into a swing trade if a short trade is taken.

Regarding the USD, there will be a release of the FOMC Meeting Minutes at 7pm London time. There is nothing of high importance scheduled today concerning the GBP.