As August gets ready to begin, ADA/USD has achieved a ten-day bullish cycle as it correlates to the broad cryptocurrency markets. Bullish traders who remain breathing but have been burdened by a strong mid-term trajectory downwards may be feeling better regarding their outlooks and the prospect for higher values in the weeks ahead. However, before buyers join any optimistic parades, they will be wise to remember and take note of July’s technical chart which remains mixed. Cardano’s high for the month of July was accomplished on the 4th with a price near 1.495000; ADA/USD touched a low of about 1.020000 on the 20th of July.

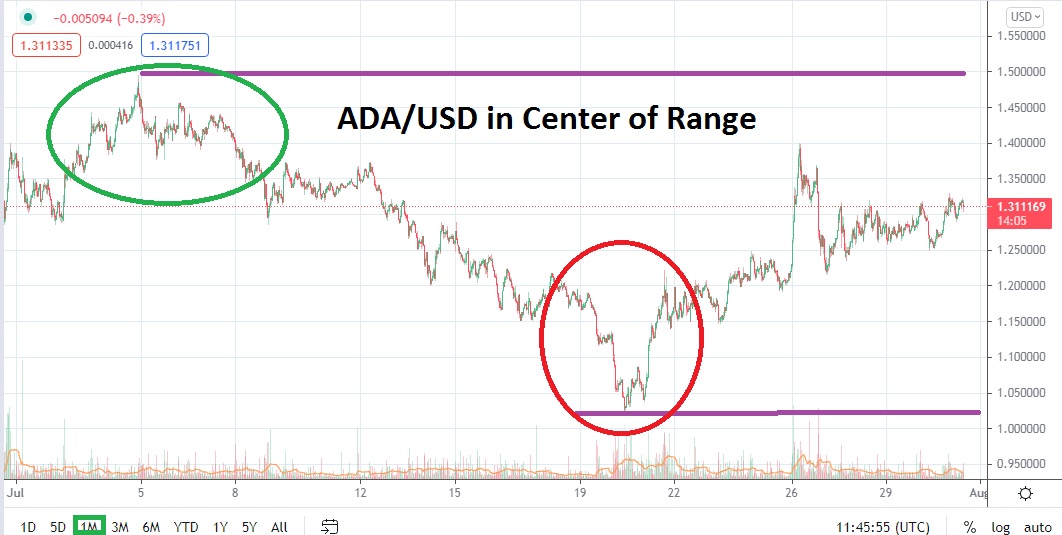

While the ten-day run upwards exhibited at the end of July now has ADA/USD near the 1.310000 juncture, and resulted in a gain of nearly 33% the past week-and-a-half, Cardano remains starkly below early July highs. Optimistic bullish traders may see current prices as a sign that ADA/USD has more ground it should attain and that a retest of the highs of early July are a given. But are they? Since trading at approximately 2.500000 in the middle of May, ADA/USD remains within the lower depths of its three-month technical charts. And a glance at the one-month chart shows values sitting in the center of the existing range.

Highs attained on the 26th of July near the 1.400000 mark were impressive considering Cardano was hovering slightly above the 1.000000 mark on the 20th of July, but the past few days has seen a reversal lower take place. True, trading direction is never a one-way street and ADA/USD is a volatile cryptocurrency asset which is known to test the fortitude of its speculators. However, from a technical perspective, ADA/USD remains below established resistance from the first week of July. The spike higher between the 25th and 26th of July did add more than 20 cents of value to Cardano for traders in one day, but the 1.400000 level proved stiff resistance. While broad market sentiment may be generating positive thoughts, technical resistance levels are demonstrating potential difficulty.

As the month of August gets ready to start, speculators who have been taking advantage of the bearish trajectory within ADA/USD may still believe there is ammunition to fire while attempting selling positions. The broad cryptocurrency market has certainly produced upwards momentum the past week-and-a-half, but are the results being seen in ADA/USD and other major digital assets a false breakout for the time being? Yes, it is likely a strong wave of buying will gather force within Cardano and produce a tangible bullish trend, but until key resistance levels are broken, traders who favor selling wagers are still circling the water and waiting for opportunities to strike.

Cardano Outlook for August

Speculative price range for ADA/USD is 1.000000 to 1.630000.

Yes, the predicted price range of Cardano remains wide and past results are an obvious reason for this. However, the projected top value for ADA/USD actually is lower than July’s forecast because resistance looks durable. If resistance near the 1.380000 level can be tested and values are sustained above, the 1.400000 juncture will become an immediate focus. ADA/USD can move swiftly, and gains and falls of 20 cents and more within a single day are a definite feature of the cryptocurrency on occasion. If sustained buying dominates and higher values are brushed aside, ADA/USD could certainly test the 1.630000 ratio and pass it higher.

ADA/USD, however, still has speculative bearish traders who may be anticipating weakness to develop. If the 1.400000 level actually proves adequate above, traders may believe this is a signal that additional weakness will reignite. If Cardano starts to test the 1.250000 mark below and does not show much ability to surpass this level, traders will target values below. Sentiment remains fragile in the broad cryptocurrency market, and if other support junctures below become vulnerable a test of July lows could erupt quickly for ADA/USD.