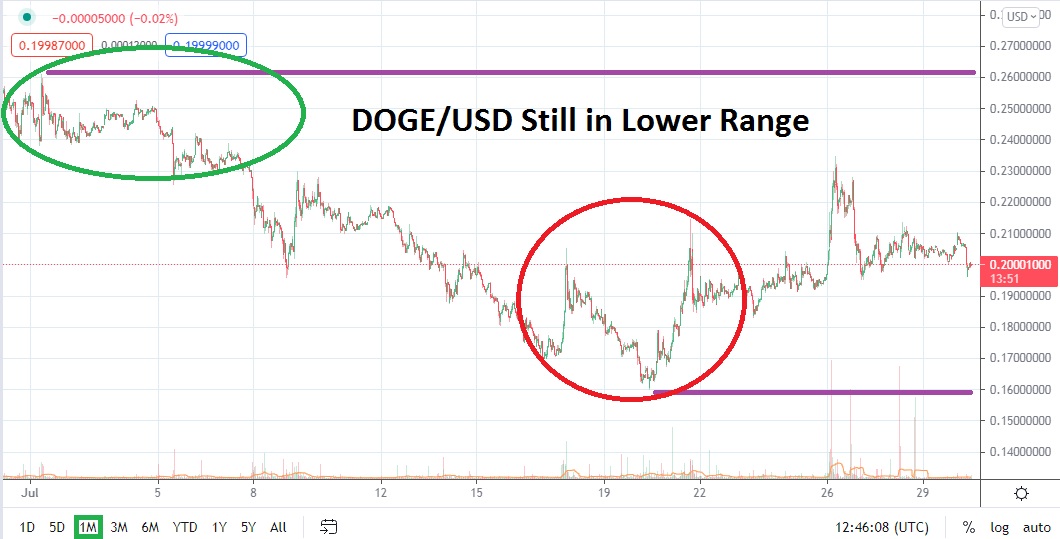

As the month of August gets ready to be underway, DOGE/USD has easily maintained its status as the go-to cryptocurrency for adventurous speculators who like vast percentage changes in value. On the 20th of July, Dogecoin hit a low slightly beneath the 16 cents ratio and, on the 26th, DOGE/USD was trading around the 23-and-a-half cents mark. As of this writing, Dogecoin is touching the 20 cents juncture. What should interest technical traders is that in the midst of the recent bullish surge seen across the board in the broad cryptocurrency market, DOGE/USD was not able to challenge previous highs seen in early July.

Perhaps in the coming days, DOGE/USD may reverse higher and be able to test prices from the 4th of July when the cryptocurrency was trading above 25 cents. On the 1st of July, DOGE/USD was trading near 26 cents. However, the highs recently achieved on the 26th remained below these heights and never showed any signs of testing the upper realms via one-month technical charts. DOGE/USD remains a favorite of speculators who look at cryptocurrencies as a place to wager. While influencers certainly have a large amount of followers and continue to proclaim the cryptocurrency, recent trading results have correlated to the broad crypto market, except to say DOGE/USD remains in its lower price range and the influencers have not been able to lead a significant charge upwards.

Higher values seen in June still seem far out of reach and it will take a sustained volatile spike higher to propel DOGE/USD into its price range of mid-June. Perhaps also worrying for traders who only seek upside potential with DOGE/USD is the notion that the lows made on the 20th of July had not been touched since late April. While bullish speculators may believe that these cheaper values are a buying opportunity for DOGE/USD, a vast sea of buying volume has not been demonstrated yet, and because of this, the cryptocurrency is still actually within sight of dangerous mid-term lows.

If the current 20 cents ratio does not hold and trading continues to test lower realms, bearish traders may be willing to attempt following what they perceive as a downward trend. As the month of August gets ready to start, the broad cryptocurrency market has staged a reversal higher, but resistance has started to also push back many of the cryptocurrencies in the short term. If DOGE/USD is not able to stop the headwinds and other major cryptos stay under pressure too, this may indicate another cycle of selling could build.

Dogecoin Outlook for August

Speculative price range for DOGE/USD is between 14 and 33 cents.

Volatility is the name of the game when trading DOGE/USD. While some days may produce what feels like rather polite trading results, others have the capability to jettison value changes of over 10% in quick strikes. If the current 20 cents support level fades and 19 cents and 18 cents begin to see tests, this could set off additional surges lower which try to approach lows seen only ten days ago slightly below 16 cents. If the lows of July the 20th do not hold, DOGE/USD could certainly move toward marks it has not exhibited since the second week of April.

Bullish speculators and proponents of DOGE/USD still have power and they should not be forgotten. Having reached a high above 23 cents only a few days ago, DOGE/USD has the capability to rapidly climb, and if the high from the 26th of July is surpassed and the 24 cents mark is toppled, a bullish parade of momentum could ensue quickly. Traders should watch the 24 cents to 26 cents junctures carefully. Any move above 26 cents, which was last seen in sincerity the last week of June, could change sentiment to a favorable bullish cycle. Then the 28 cents and 30 cents ratios would need to be watched. Dogecoin remains a speculative playground. Sold risk management is always needed when trading DOGE/USD.