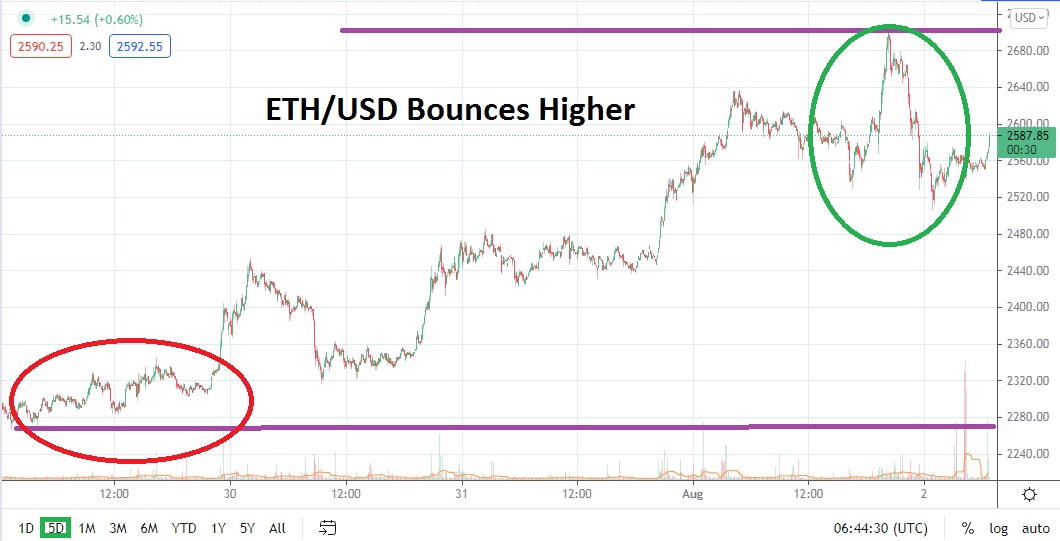

ETH/USD flirted with the 2700.00 mark in early trading yesterday, only to suffer a swift reversal lower which saw the 2500.00 juncture approached late last night. However, since reaching the short-term lows and support proving adequate, ETH/USD is now trading near the 2635.00 ratio. Perhaps significantly, the lows reached by ETH/USD as it came within sight of the 2500.00 did not penetrate lower the trading action from the 30th and 31st of July which produced a leg upwards and was able to bust through resistance at that time of 2400.00.

The broad cryptocurrency market is exhibiting volatility as resistance levels have been approached creating choppy conditions in many of the major speculative assets. The past two weeks have started to offer a glimmer of a hope for traders who have bullish sentiment. Having suffered through a violent bear market in the mid-term, market participants who like to be buyers of cryptocurrencies with the dream of catching the next big trend up are certainly being given reasons to be enticed.

Let there be no doubt that suspicious traders still abound, and technically ETH/USD still remains within the grip of its bearish mid-term price range. The 2700.00 mark proved powerful yesterday as resistance and currently the 2666.00 level should be watched by bullish traders who want more momentum higher in order to buy into a positive trend.

Support near the 2600.00 juncture obviously should be watched and if the 2583.00 mark below becomes vulnerable, then this could set off alarm bells and the notion that more selling is about to occur. Although it is a wide range, speculators should keep their eyes on the 2400.00 to 2700.00 price range. A move above 2700.00 and sustained value near the vicinity would be a signal that more buying will follow. A move below the 2500.00 level and a test of 2400.00 may mean that what has been demonstrated is a false breakout the past five days of trading.

Short-term traders should expect choppy conditions today and they should use limit orders to protect against spikes.Traders should look for quick-hitting trades using tight take profit and stop loss orders to get into and out of ETH/USD quickly to take advantage of present conditions.

Ethereum Short-Term Outlook:

Current Resistance: 2666.00

Current Support: 2583.00

High Target: 2700.00

Low Target: 2527.00