The euro was all over the place on Wednesday as we chop around waiting for clarity from the Jackson Hole Symposium about tapering. After all, the only thing that people have been paying attention to for the most part recently has been whether or not the Federal Reserve is going to slow down its bond buying purchases. If they do, then that should drive up the value of the US dollar in general, and that will work against the value of the euro.

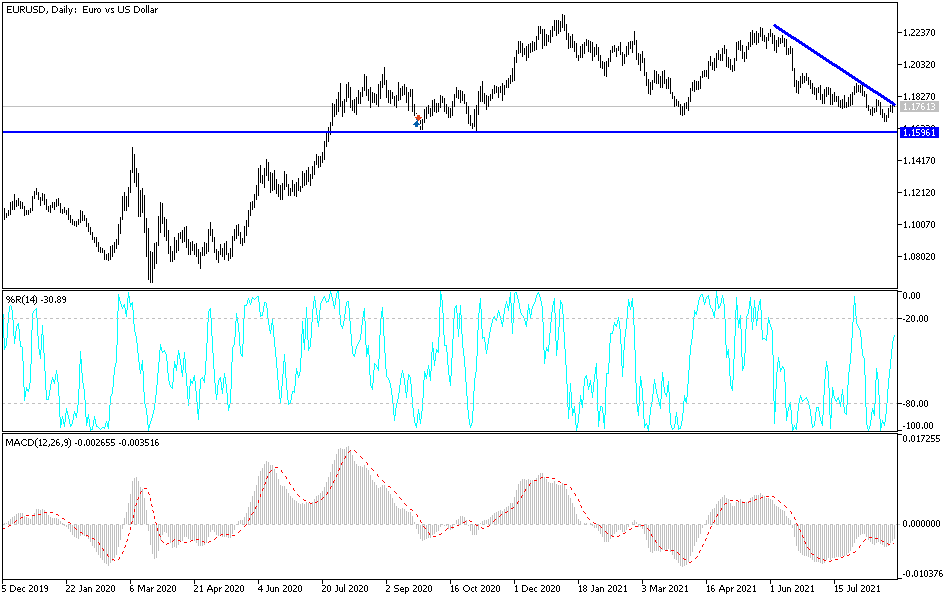

If we were to break down below the lows of the trading session on Wednesday, which by extension means that we would be breaking down below the lows of the Tuesday session, it would be the breaking of two hammers, which is an extraordinarily negative sign. At that point, I would anticipate that the pair could drop down to the 1.17 level, followed by an even bigger move to reach down towards the 1.16 level where we had seen a lot of support previously. Nonetheless, this is a market that I think is going to move based upon headlines, and at this point we are simply killing time and trying to figure out where to go next. The markets have also been forming a bit of a “falling wedge”, which is typically a positive indication, but I do not trust this formation overall, although occasionally it could produce a decent trade.

As soon as we get a bit of clarity from the Federal Reserve, we could get an idea as to where this market goes over the longer term, with the 50-day EMA above being a target for bullish momentum. After that, then you can start looking at the 200-day EMA. To the downside, if we were to break down below the 1.16 level, it would be an extraordinarily negative turn of events and could send the US dollar much higher. Whether or not the Federal Reserve can convey its message to the market will have a lot to do with what happens next. There are concerns about inflation, and several Federal Reserve governors have suggested that perhaps tapering may come between now and the end of the year. If that message is reiterated, the US dollar is about to have a very strong run.