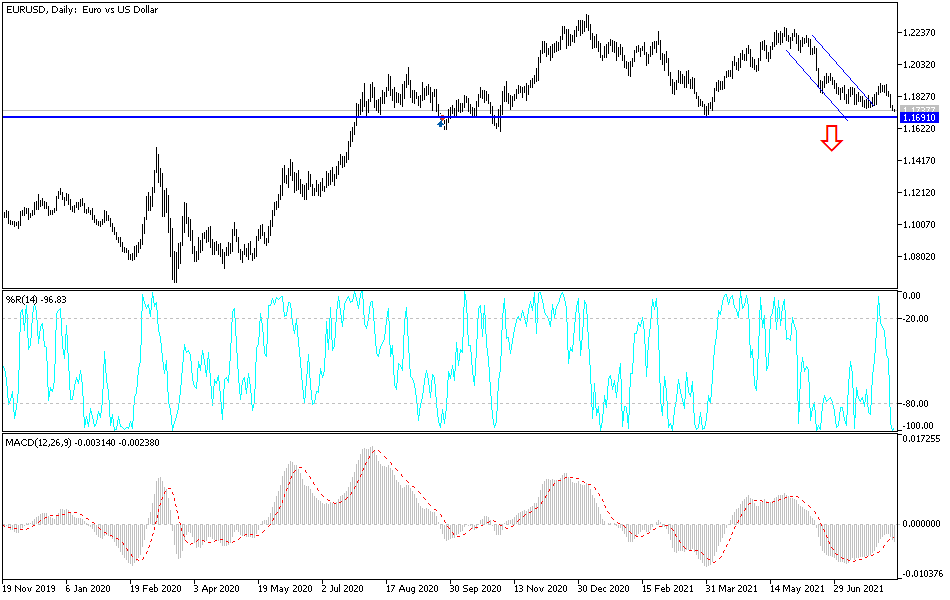

Bearish View

Sell the EUR/USD (bearish flag pattern).

Add a take-profit at 1.1650.

Set a stop-loss at 1.1800.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.1800 and a take-profit at 1.1900.

Add a stop-loss at 1.1700.

The EUR/USD pair remained under pressure during the Asian session as investors refocus on the upcoming German sentiment and US inflation data. The pair is trading at 1.1750, where it dropped following the impressive US employment numbers.

German Sentiment Data

The EUR/USD remained close to its lowest level since July 23rd after the latest strong jobs numbers from the US. In a report, the Labour Department said that the total number of open vacancies rose from more than 9.4 million in June to more than 10 million in August.

This was substantially higher than the lowest level during the pandemic. Also, it was the highest level ever. This is a sign that employers are still struggling to find workers as the economy rebounds. The US vacancies numbers came two days after the US data showed that the economy added more than 943k jobs in July as the unemployment rate declined to 5.3%.

The pair also remained unchanged after the latest German trade numbers. According to Destatis, the country’s exports jumped by 1.3% in June after rising by 0.4% in the previous month. In total, the country exported goods worth more than 118 billion euros. The country imported goods worth more than 102 billion euros, which pushed the trade surplus to more than 16 billion euros.

Looking ahead, the next key catalysts for the EUR/USD pair will be the latest German sentiment data published by ZEW. The current conditions is expected to improve from 21.9 to 30.0 in August. On the other hand, the economic sentiment is expected to decline from 63.3 in July to 56.7 as German companies continue worrying about supply shortages and the rising number of Covid cases. The next catalyst will be the latest US inflation numbers scheduled for tomorrow.

EUR/USD Forecast

The EUR/USD declined to a low of 1.1740 after the strong US vacancies data. Looking at the two-hour chart, we see that the price is between the lower and middle lines of the Bollinger Bands. It is also below the 25-day moving average. Notably, the pair has formed a bearish consolidation pattern.

Therefore, the EUR/USD will likely maintain the bearish trend as investors target to move below the 1.1700. However, a move above the resistance at 1.1800 will invalidate the bearish view.