The EUR/USD has been trying to correct upwards, but its gains did not break through the 1.1765 level, instead settling around 1.1740 as of this writing. The pair is waiting for a catalyst to release it from its bearish trend, which pushed it towards the 1.1665 lowest support level this year. The delta variant and growing expectations of a tightening of monetary policy by the Federal Reserve are the most prominent factors that weakened the currency pair recently. Commenting on the pair's recent performance, some analysts say the rallies should find appropriate resistance at this week's high at 1.1804 and will be ideally contained by the short-term downtrend also at 1.1804 so that the negative bias remains entrenched.

The level of 1.1804 closely coincides with the initial Fibonacci retracement of the corrective decline in the EUR/USD since June, which is reinforced by the 23.8% initial retracement of the overall movement for 2021, which is located at 1.1825. The above is supported by the declining 55-day average at 1.1867, forming massive resistance that could act as an open call for sellers this week in the absence of a catalyst to reverse the bearish market view of the euro, or the bullish outlook for the dollar.

However, the problem with the price of the EUR/USD is that tomorrow, Thursday, the minutes of the European Central Bank meeting in July will be released, which will risk drawing investors' attention back towards the potentially long wait before the US Federal Reserve is likely to begin to change its monetary policy.

Chris Turner, an analyst at ING Bank, told clients last week that there is a risk of a slide in the price of the EUR/USD towards 1.16 in the coming days. “The dollar is being pushed higher by the combined forces of the Fed moving towards reducing purchases and reassessing global growth prospects from the outbreak of the COVID delta variable and will be first in focus this week.”

The ECB meeting minutes come ahead of Friday's speech from Fed Chairman Jerome Powell at the annual Jackson Hole Symposium in Wyoming at 15:00 London time. This is the most important event this week for global financial markets and will bring the collective focus back to the dollar-supportive United States. Attention will be on politics and the question of when the Fed is likely to start ending its $120 billion a month quantitative easing program.

The minutes of the Federal Reserve's meeting in July last week suggested that the bank might announce as well as begin the process of tapering its bond-buying program before the end of the year, putting more wind in the dollar's sails and weighing on the EUR/USD rate along the way.

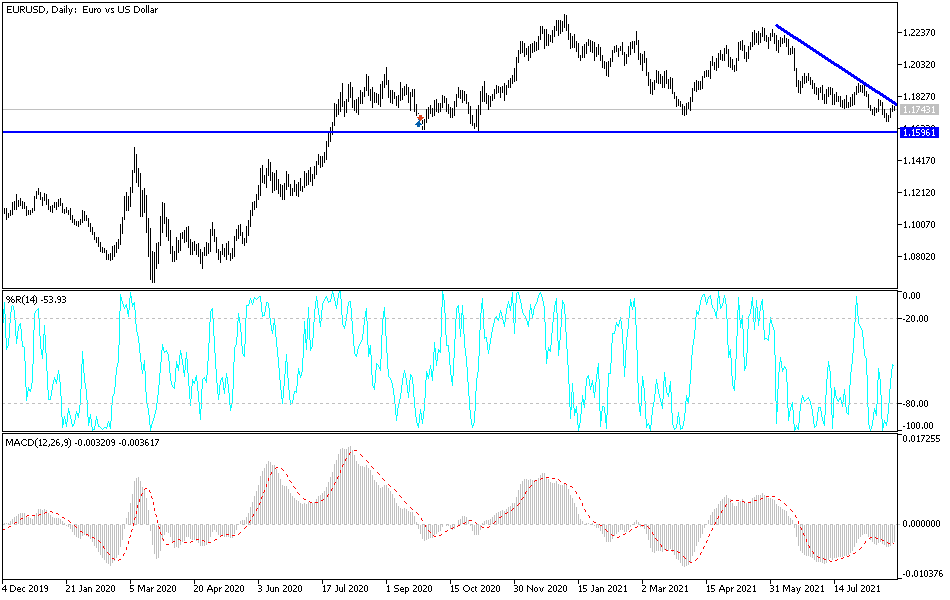

Technical analysis of the pair

The German Ifo business climate reading is expected to decline today, thus joining a series of negative results for the largest economy in the Eurozone. This confirms that the Eurozone is very sensitive to the renewed outbreak of the epidemic, and therefore the EUR/USD may remain in its current bearish state due to lack of a catalyst. The pair may move towards the support levels at 1.1690, 1.1600 and 1.1545.

On the upside, and according to the performance on the daily chart, a break through the 1.1800 resistance may be an opportunity to break the trend, and a strong reversal may come by moving above the psychological level of 1.2000.

From the USA today, the durable goods orders will be announced.