The EUR/USD has been trying to correct upwards, ultimately jumping to the 1.1802 resistance level on Friday, a 2-week high, before closing trading around 1.1795. This comes despite clear indications from Jerome Powell at the Jackson Hole Symposium that the Federal Reserve plans to reduce bond purchases, paving the way to raise US interest rates. The chief US monetary policy official intimated that that might happen in the final months of 2021.

The euro gained momentum as a funding currency when the US Federal Reserve's tendency to cut stimulus was compared with the European Central Bank. The discount to the overnight rate for borrowing the euro instead of the dollar rose earlier this month to the highest level since 2020. This increased returns on euro-financed carry trades, which were among the best performers this year.

Last Friday, Federal Reserve Chairman Jerome Powell said it might be appropriate to start tapering off the $120 billion a month bond-buying program this year, even though the US central bank will not be in a hurry to start raising rates after that. In turn, the European Central Bank stressed that it may continue to buy bonds until next year, even after the end of emergency asset purchases. Deutsche Bank analysts assert that if the European Central Bank continues to be enthusiastic about other central banks over the next few years, this will increase the attractiveness of the euro as a financier.

European Central Bank officials still erred on the side of more stimulus even as they recently indicated that their recent shift in forward guidance does not necessarily mean a longer period of lower interest rates. This year, euro-funded carry-adjusted deals generated positive returns for 17 of the 23 emerging markets that Bloomberg tracks. The same action for those who were financed by the dollar caused losses for 15 of them.

While the bulk of this performance can be explained simply by the weakness of the euro - it has fallen nearly 5% against the dollar since the beginning of the year - it also underscores the impact of widening policy divergence across the world's largest central banks. Investors are betting that the Fed will raise interest rates by 25 basis points by the beginning of 2023, while the European Central Bank is not expected to raise the deposit rate until 2024.

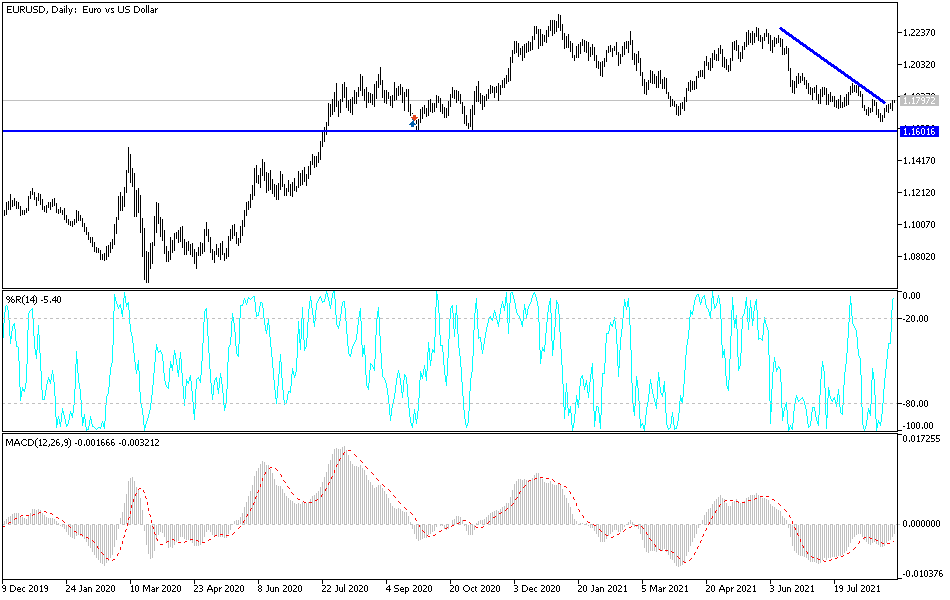

Technical analysis of the pair

On the daily chart, the EUR/USD currency pair is in a clear break of the current bearish trend, and with stability above the 1.1800 resistance, the bulls may have the opportunity to move towards higher levels. A move above the 1.2000 psychological resistance would be crucial for bulls. On the downside, the support at 1.1725 will be a chance for the bears to move down again.

Concerns surrounding the Delta variant is ultimately in the interest of the US dollar, as a safe haven.

The German and Spanish CPI figures and the US pending home sales will be released. It must be taken into account that the currency pair is expecting inflation figures in the Eurozone and US jobs numbers this week.