The GBP/USD broke through important support at 1.3800 to reach 1.3790, and with the US dollar's decline at the end of last week's trading, it rebounded to the 1.3870 resistance and closed around there. So far, the main downside risks for the British pound in the near future are a drop in global stock markets according to analysts, confirming that global risk sentiment is one of the major external drivers of the British currency. Underlining this, the British pound pulled back from multi-month highs against the euro and retreated against the US dollar due to a bout of risk aversion among global investors who seem to have been spooked by some lively US inflation data.

Dollars were bought and stocks sold after the US Producer Price Index rose 1.0% month-on-month in July, exceeding the 0.6% market expectation. The data indicates that US inflation will remain at high levels for some time now, calling for the possibility of tightening monetary conditions at the US Federal Reserve over the coming months, a move that would create potential headwinds for US and global economic growth.

While UK fundamentals are broadly supportive - as confirmed by better-than-expected UK GDP data - the global picture remains important for the GBP. When stock markets suffer from investor anxiety, sterling often comes under pressure. Commenting on this, Stephen Gallo, European Head of FX Strategy at BMO Capital Markets says, “What is likely to be more important for the EURGBP during August's performance is the risk appetite in global financial markets. And we can say that this factor, in the context of the situation of investors, was the biggest damage to further decline of the currency pair.”

On the future of monetary policy, which provided some support to the pound in the Forex market, the August monetary policy decision from the Bank of England (BoE) gave businesses and households advance notice that interest rate normalization could be most likely over the next year or so, although there is still a wide variety of views among analysts and economists on the question. The exact time when borrowing costs and savings returns are likely to rise.

This month's policy decision proved to be a milestone in the UK economy's journey through the pandemic after an announcement by the Bank of England revealed that an unknown number of eight participants at the August Monetary Policy Committee (MPC) meeting believed that the Bank's minimum economic limits entailed a rate that has already been fully met in recent months.

The minutes of the MPC meeting stated: “Some members of the Committee considered that despite the significant progress that has been made in achieving the terms of the MPC’s current policy guidance, the conditions have not yet been fully met.” The minutes also stated, “Other members of the Committee considered that the conditions for the current policy guidance had been fully met, as evidenced by developments in economic data and the latest central projections for excess capacity and CPI inflation in the August report, but noted that the guidance made clear that these conditions were never necessary, nor were they sufficient for any future monetary policy tightening.”

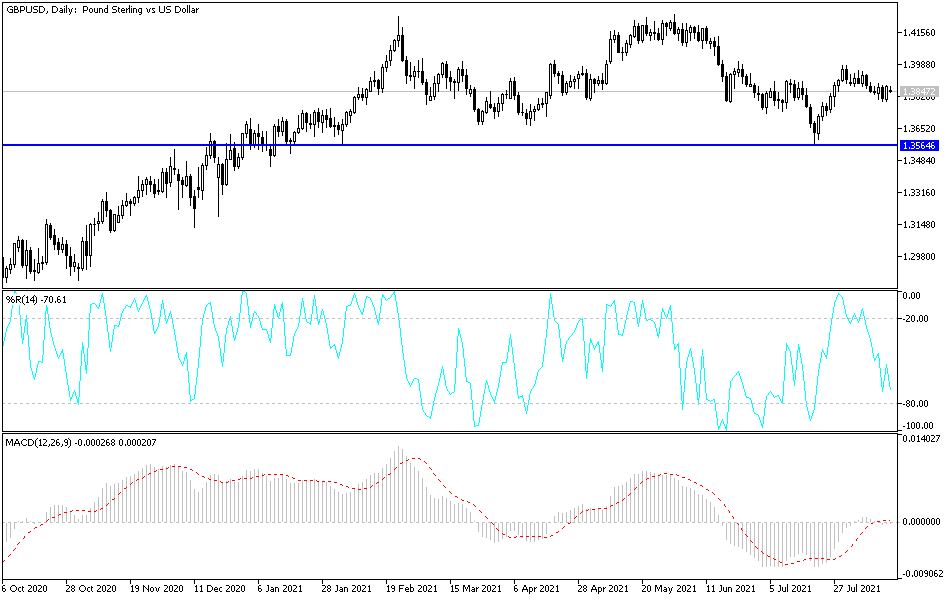

Technical analysis of the pair

On the daily chart, it clearly shows the neutrality of the performance of the GBP/USD currency pair. The pair will not become bullish again without breaching the 1.4000 psychological resistance, which increases buying to move towards higher highs that ensure the continuation of the trend . On the downside, the breach of the 1.3765 support will negatively affect the bullish expectations because it will stimulate the bears to move towards stronger support levels.

Risk appetite, the performance of global stock markets, and the COVID infection rate will have an impact on the currency pair’s movement today, amid the scarcity of important US and British economic data.