The GBP gained some momentum last week against the other major currencies, namely the dollar, the euro and the Japanese yen. As the US Federal Reserve indicated that it will remain patient and continue to provide support to the US economy in the coming months, the rebound gains for the GBP/USD reached the resistance level of 1.3780 and started this week's trading around 1.3750. This confirms that the pair is looking for catalysts for its rebound to continue.

The US dollar fell sharply and stock markets rose after Federal Reserve Chairman Jerome Powell said at a Jackson Hole seminar that while the Fed is likely to start ending its asset purchase program in 2021 (cutting quantitative easing), this does not mean that interest rates in the US will rise shortly. Indeed, the gap between when the Fed intends to end quantitative easing and when an interest rate hike will occur appears to be much larger than the market had expected.

This mismatch between market expectations and the Fed's signals should pressure the yield-paying US bond yields lower, which in turn deprives the US dollar of support. The rise in global stock markets also indicates a strong “risk” tone on investor sentiment towards the end of the month, and these conditions will allow the pound to rise against other currencies such as the euro, the US dollar, the Swiss franc and the Japanese yen.

But the losses come against those currencies that fully thrive when investors are bullish: the Australian, Canadian and New Zealand dollars, as well as emerging market currencies like the rand.

Jerome Powell has confirmed that tapering will happen by the end of 2021, but there was no clear indication as to whether the cut in QE would happen in November or December. Meanwhile, the Fed said at various points in 2021 that if the labor market improves significantly and inflation breaches 2.0%, tapering conditions will be met. "My view is that the test of 'extra significant progress' has been achieved with respect to inflation," Powell stated. "There has also been clear progress towards maximum employment."

Prior to the event, analysts had seen Powell's indication of whether a gradual decrease would happen in November or December as significant, with the gradual decline in November being bullish for the dollar. But, ultimately, timing is now less important in the larger scheme as the Fed will sit in once the tapering is complete and take its time before raising rates.

Ultimately, the Fed and the market were unbalanced in their expectations regarding the outlook for US interest rates. For dollar bulls, this miscalculation has proven costly.

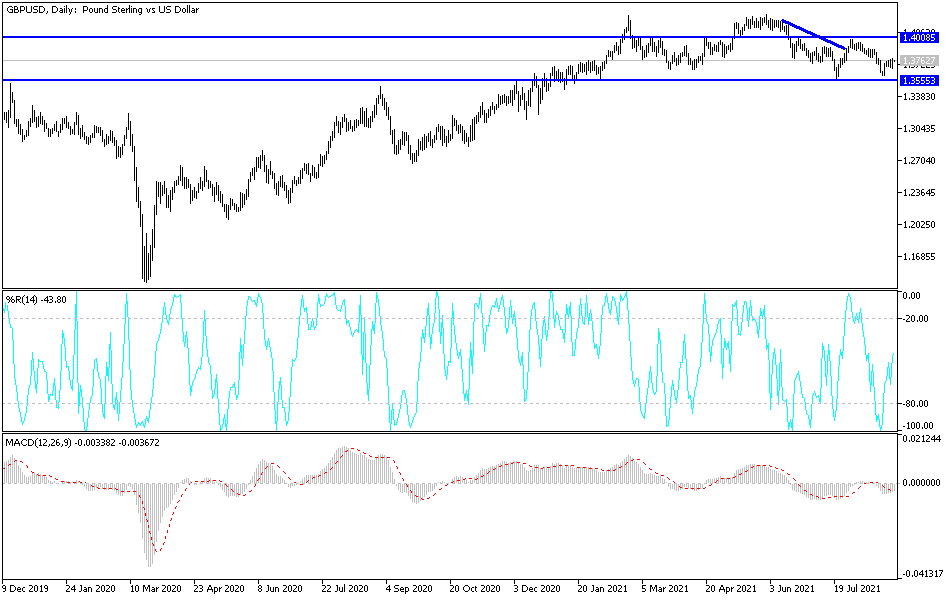

Technical analysis of the pair

The GBP/USD is still neutral with a bearish bias as shown on the daily chart. An actual reversal of the general trend will not occur without testing the psychological resistance at 1.4000. On the downside, the support level of 1.3680 is crucial for the bears to continue dominating the performance and to solidify the general bearish trend. COVID fears will be a catalyst for the US dollar to start rising again.

Today is a British holiday, and from the US, the pending home sales will be announced. The currency pair will be affected by risk sentiment and the performance of global stock markets.