Since the start of this week's trading, the sterling dollar currency pair has been moving in a range between 1.3870 and the 1.3939 level, and is settling around the 1.3930 level at the time of writing the analysis. All in all, the pound stumbled in August, falling against the euro, dollar and a host of other currencies, as investors prefer to wait before the Bank of England monetary policy meeting tomorrow Thursday.

The policy update coincides with the release of the quarterly Monetary Policy Report which is likely to provide some much-needed clarity on whether to raise interest rates in 2022. Weakness in the British currency has pushed the pound-to-euro exchange rate below the key level 1.17. The drop in value is in line with the new situation data in the forex foreign exchange market which shows that investors are increasingly turning to the downside of the GBP, having added to the bets for further decline.

Data from the CFTC - the most comprehensive set of positioning data available - showed that net bets against sterling rose by $195 million to $493 million last week, largely due to a sharply lower total of long positions. Investors built a net bet against sterling for the first time in two months two weeks ago, a development that coincided with a slowdown in UK business activity that came along with the third wave of Covid-19 infections.

Looking ahead, the cancellation of a net 'long' bet on sterling - the position that favors gains in the currency - means the situation is no longer a headwind for gains in the event of a BoE policy event seen as more "tight" than what the market had been expecting. This is because positioning data is often viewed by analysts and traders as a counter-intuitive signal that when the market is heavily invested in a position, a bounce in the opposite direction is likely.

Investors bet heavily on sterling gains for most of 2021 and the popularity of the trade was in fact one of the greatest headwinds against further gains in sterling. Therefore, the current situation may not be considered a source of potential resistance to the rise of the British currency from the current levels.

In this regard, Robert Howard, a market analyst for Reuters, says: “More short positions in the pound may be abandoned if the Bank of England monetary policy committee launches a hawkish surprise on Thursday.” Markets are largely anticipating the BoE to announce no fundamental changes to its policy, opting to keep interest rate settings and quantitative easing levels unchanged. But the bank will readjust its economic forecast and provide guidance on ending the quantitative easing program while addressing interest rate expectations.

The analyst adds, “The sudden reduction of the quantitative easing program could boost the pound, given that a 7-1 or 6-2 vote is expected to keep QE at full speed. The Pound may also benefit from a larger than expected increase in Bank of England inflation expectations. Because this could raise the perceived probability of a BoE rate hike earlier than expected” and “the pound may also react positively if the BoE highlights how and when the stimulus program might throw in the opposite direction.”

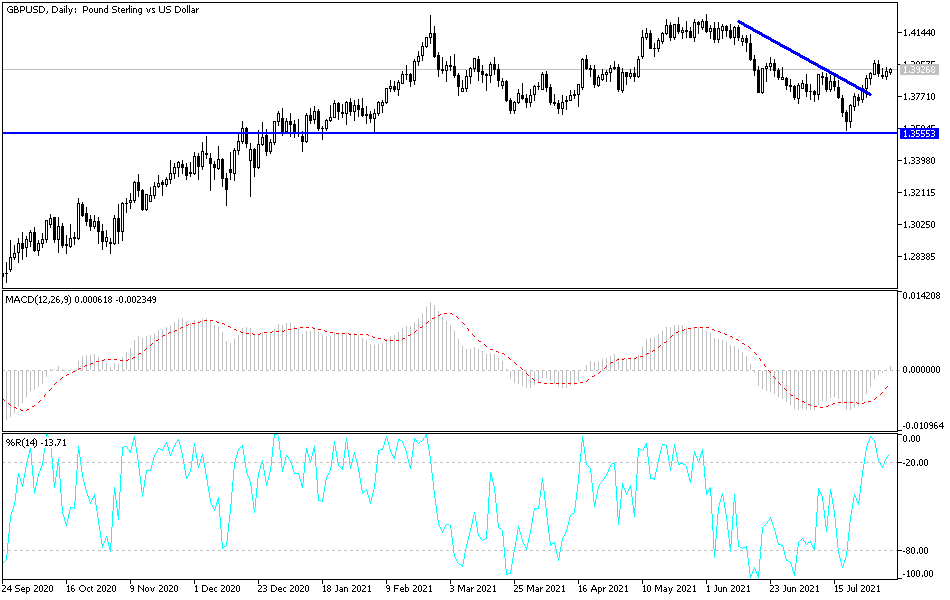

According to the technical analysis of the pair: No change in performance, no change in expectations. On the daily chart, the price of the GBP/USD currency pair is still in the phase of breaking the bearish trend and to strengthen the current opposite channel on the bulls to breach the resistance levels 1.4000 and 1.4120, respectively. On the other hand, the currency pair may abandon the current bullish view if it returns to move towards the resistance level of 1.3775, which stimulates the bears to control performance again. The future performance of the currency pair will depend on the numbers of British injuries with the Corona Delta variable, with a complete British abandonment of the epidemic restrictions, as well as the reaction to the monetary policy decisions of the Bank of England, and then the US job numbers.

Today, the sterling will be affected by the announcement of the British Services PMI, the most important economic sector in the country. The US dollar will be affected by the announcement of the first reading of the US labor market, the ADP survey to measure the change in non-agricultural jobs, and then the ISM purchasing managers' index for services.