SafeMoon/USD began trading in the middle of March and it is only available on a limited amount of trading exchanges. The founders of SafeMoon have said that they will release a cryptocurrency wallet component in the near future which will make buying SafeMoon easier via USD. The cryptocurrency trades fractionally, so speculators who are able to purchase the coin need to be extremely careful regarding the amount of leverage they use when they have this capability.

SafeMoon, for the moment apparently, can mostly be bought by using other cryptocurrencies and not USD. The marketing team of SafeMoon has stated that selling SafeMoon will carry a 10% charge, which in theory is supposed to limit the amount of speculative wagers being made in order to penalize ‘investors’ who are trying to take advantage of quick trading opportunities.

SafeMoon has also reportedly stated that it will eliminate a percentage correlated to the sale of their cryptocurrency. In theory this suggests the 10% charge for selling the digital asset via exchanges will eliminate a comparable amount of SafeMoon. This is supposed to make the cryptocurrency more valuable in the future as supply becomes more limited.

If you are confused by the above and wonder what utilitarian purpose SafeMoon is going to be used for, this will not make you feel better either. For the moment, the cryptocurrency carries no known usage profile which it is proclaiming, leaving its core value at the mercy of speculative forces. In reality, taking into consideration the working intentions of SafeMoon, it should be viewed by short-term traders as a purely speculative wager.

These are still early days for SafeMoon and buying or selling the cryptocurrency can be compared to the beginnings of the cryptocurrency market when people used to question the value of other digital assets. Perhaps a utilitarian purpose will arise and perhaps a solid cryptocurrency wallet for SafeMoon will be launched.

These concerns have limited answers which makes buying SafeMoon extremely speculative in the short term. Traders who can buy and hold SafeMoon and risk a small amount of money with the hope that potential gains will be made cannot be faulted for attempting this track. However, since reaching highs in the third week of April, SafeMoon has slid and is approaching the lower realms of its value.

SafeMoon Short-Term Outlook:

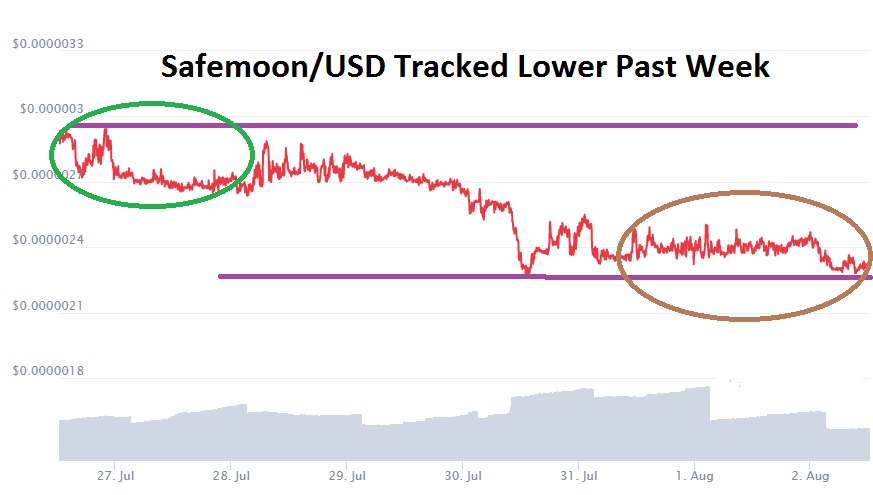

Current Resistance: 0.000002325

Current Support: 0.000002220

High Target: 0.000002420

Low Target: 0.000001891