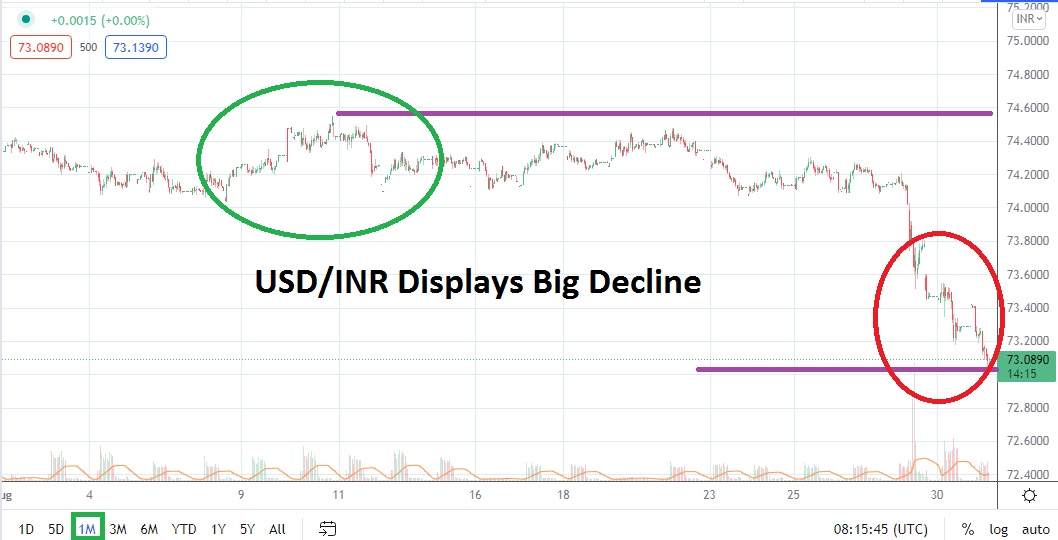

After witnessing a rather strong bullish trend emerge in the USD/INR since the beginning of June and higher values sustained during most of August, the Forex pair has seen a dramatic and stark selloff emerge suddenly. As the month of September gets ready to start, the USD/INR saw its biggest bearish selloff of the year take place on the 27th and 30th of August.

The USD/INR started the trading day near the 74.2000 juncture on the 27th, but a gap lower in the middle of the trading day witnessed a fall to nearly 73.5500. The bearish situation didn’t produce a reversal upwards of any merit and, after yesterday’s trading, the USD/INR is near the 73.1000 vicinity as nervous conditions exist on this last trading day of August.

As September gets ready to start, traders suddenly need to consider low water marks of the USD/INR not demonstrated since the 11th of June. Speculators who are accustomed to reversals taking place and are skeptical of strong exuberant moves may skeptically believe a ‘correction’ upwards needs to take place. However, traders are advised to note the market doesn’t have to please speculators, and that the actual price of the USD/INR may prove to be durable and create a ‘new’ trading range which simply engages values from nearly three months ago.

The USD/INR did have a ‘feel’ of having been overbought the past couple of months, but this took place as questions persisted regarding the direction and gyrations from the U.S Federal Reserve, which for a while made sure its whispers about the potential of more hawkish policy was heard. In a change of tone the past week, the U.S central bank has said it is starting to see inflation concerns recede.

There are also worries about the potential of a U.S economic slowdown. These two bits of news have likely been a potential part of the USD becoming weaker in global Forex the past week. The USD/INR which may have been overbought as a cautionary action by financial houses, could have been thrust into selling momentum as institutions became more confident about the prospects of a potentially weaker USD mid-term.

Indian Rupee Outlook for September

Speculative price range for USD/INR is 72.4500 to 74.2500.

Have switched its trading range within the blink of an eye, predicting the next month of trading for the USD/INR may prove to be extremely foolish. However, if current support ratios prove to be vulnerable, there is reason to suspect the USD/INR could trade below the 73.0000 as it did in June of this year. If the 73.0000 is proven weak and prices are sustained below this juncture, the USD/INR could certainly aim for psychological junctures quickly like 72.9000 to 72.8000. Traders may want to keep in mind that the USD/INR was trading near the 72.3000 vicinity on the 27th of May. However, aiming for this level may be far too ambitious even for the bravest of bearish traders.

Having plummeted from much higher ratios the past two days as September gets ready to start, contrarian speculators may believe the USD/INR has now been oversold. And even if it has not been oversold and can maintain its current price vicinity, some traders may suspect natural reversals higher will be demonstrated over time which will test current market conditions. If the USD/INR can climb to 73.2500 and test the juncture of 73.5000, this would not feel farfetched considering recent volatility. The question is how high the USD/INR can retrace in the next handful of weeks as it reacts to its sudden bearish stance again. Speculators who aim for higher values should make sure they use adequate risk management. The past few days of trading have proven the USD/INR can be extremely volatile.