The USD/JPY tried to settle above the 110.00 psychological resistance throughout last week's trading ahead of the Jackson Hole Symposium. Despite strong indications from Federal Reserve Chairman Jerome Powell that reducing the bank's purchases is imminent, which paves the way for raising interest rates, the currency pair fell to the support level of 109.77 after reaching the resistance level of 110.26 in the same trading session. This week's trading also started stable around the 109.85 level. The dollar pairs will be awaiting the announcement of the US jobs numbers.

During his highly anticipated speech at the Federal Reserve's annual Jackson Hole Symposium, Powell said the bank is likely to start reducing some of its easy fiscal policies before the end of the year. However, he added that he still feels there are "a lot of things to cover" before raising rates.

Powell also said that the economy has reached a point where it no longer needs much political support, noting that the Fed may start reducing the amount of bonds it buys each month before the end of 2021, provided the economy continues to advance.

“The timing and velocity of the next reduction in asset purchases will not be a direct indication as to the timing of the rate hike, for which we have formulated a different and considerably more stringent test,” Powell added in prepared remarks for the virtual summit. He added that while inflation is strongly approaching the Fed's 2% target rate, "we have a lot of ground to cover to reach maximum employment," the second prong of the central bank's dual mandate and a pre-requisite for raising interest rates.

Powell also explained why he continues to believe that rising inflation is temporary and will eventually come down to the target level. He said the inflation "test has been met" while there has been "clear progress toward maximum employment". He added that some of the factors that pushed inflation higher have begun to subside. "Inflation at these levels is of course a cause for concern. But this concern is mitigated by a number of factors that suggest these elevated readings are likely to be temporary."

Powell added that he and other Fed policymakers agreed at the FOMC meeting in July that "it may be appropriate to start reducing the pace of asset purchases this year." On the US employment front, Powell indicated that the Delta variant “represents a near-term risk” of a return to full employment. However, "the prospects are good for continued progress towards maximum employment."

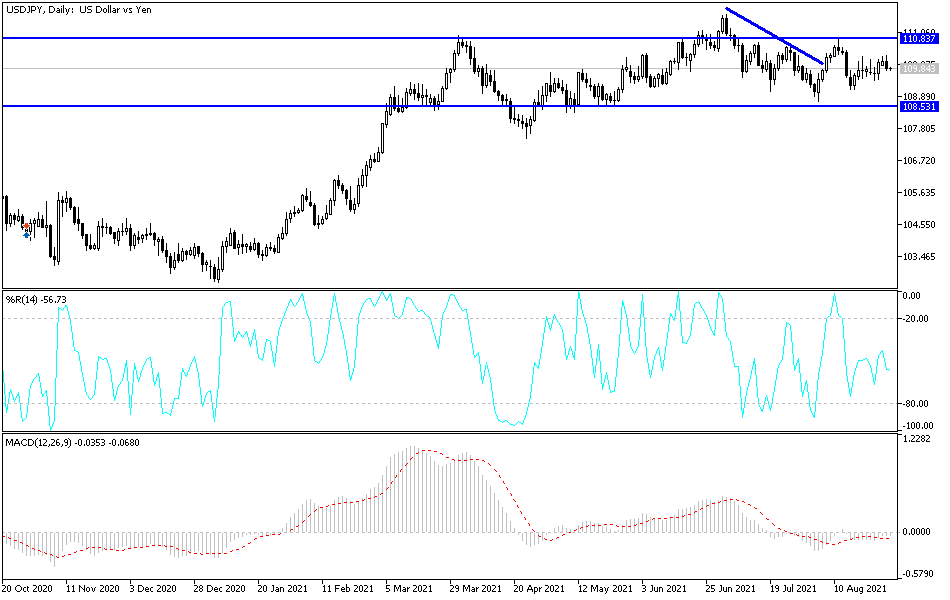

Technical analysis of the pair

Due to the failure of its current rebound attempts, the formation of a head and shoulders pattern will likely appear on the daily chart, which may be enough to activate a selloff. The psychological support level at 108.70 will remain crucial for the bears. I still prefer buying the currency pair from every bearish level, the closest of which are 109.35 and 108.80. On the upside, a break through the 110.26 resistance will bring the bulls the stimulus to move towards the next most important resistance at 111.30.

During today's trading session, the pair will continue to react to Powell's comments and risk appetite, in addition to the announcement of US pending home sales.