This is with losses that reached the support level of 109.36 and closed the week's trading stable around the level of 109.65. The US dollar was bought in the last hours of trading last Friday amid sharp details in demand that come after the release of the PMI reading from Chicago amid expectations with a bullish signal about business activity levels in the third largest city in the United States. The Chicago Purchasing Managers' Index came in July at a reading of 73.4, up from a reading of 66.1 and expectations were for a decline to a reading of 64.2, and according to the details of the release, the demand for labor increased by 3.4 points in July.

Producer prices have eased a bit, down 0.3 point but have remained at a historical high level. The results of the ISM survey are carried out in conjunction with international market news reporting expectations of rising activity and employment from already high levels, which seemed to give the previously indecisive dollar complex a clear sense of direction.

Over the past week, the US dollar suffered a setback against the other major currencies, after Federal Reserve Chairman Jerome Powell said in a press conference after last Wednesday's meeting, “I think we are far from having further progress towards maximizing employment. I want to see some strong business numbers and that's kind of the idea. Powell's comments suggested that it would likely be months from now before the Fed would update its policy settings, and until then, there was widespread consensus that the bank would announce in September a plan to begin... Willingness to ease his program, which includes 120 billion dollars a month.

The Fed's preferred inflation gauge appears to indicate that US price pressures have begun to peak in June and may prove its ailing stance on monetary policy, although economists disagree as to whether that is the case. Personal Consumer Price Expenditures (PCE) have fallen after six months of strong increases that have so far seen the annual price more than double in 2021.

Those annual rates appeared to be at their peak when the main PCE price index published by the Bureau of Economic Analysis rose 4% flat, unchanged from the 4% seen in May. Overall, the June data is likely to be important to interest rate and the broader monetary policy outlook because more than other measures of PCE price indices, they influence how the FOMC perceives and understands the overall inflation picture.

The Fed has looked through recent increases in PCE indices as well as CPI inflation rates, which have also risen this year, indicating its steadfast hand to focus price pressures within the sectors most negatively affected by the pandemic. For his part, US Central Bank Governor Jerome Powell said in his recent press conference, “When the economy continues to reopen and increase spending, we see upward pressures on prices, especially since supply bottlenecks in some sectors have limited the speed of production response in the near term.”

"These choke effects were greater than expected, but as these transient supply effects are affecting, inflation is expected to decline toward our longer-term target," Powell added.

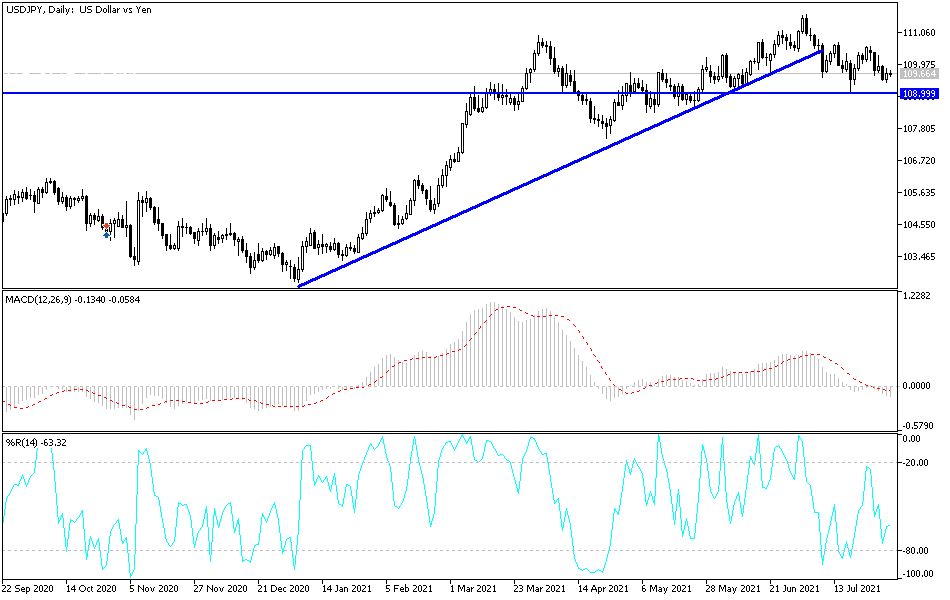

According to the technical analysis of the pair: On the daily chart, the bulls of the USD/JPY currency pair still need to break through and stabilize above the 110.00 psychological resistance in order to increase the buying positions for the pair technically, and then avoid more of the current bearish collapse. The current descending channel will be strengthened by moving towards the support level 108.80 and I still prefer buying the currency pair from every descending level. The US dollar pairs are on an important date this week with the announcement of US jobs and wages figures. The currency pair will be affected today by the extent to which investors take risks or not, as well as the announcement of the US ISM Manufacturing PMI, along with the construction spending index.