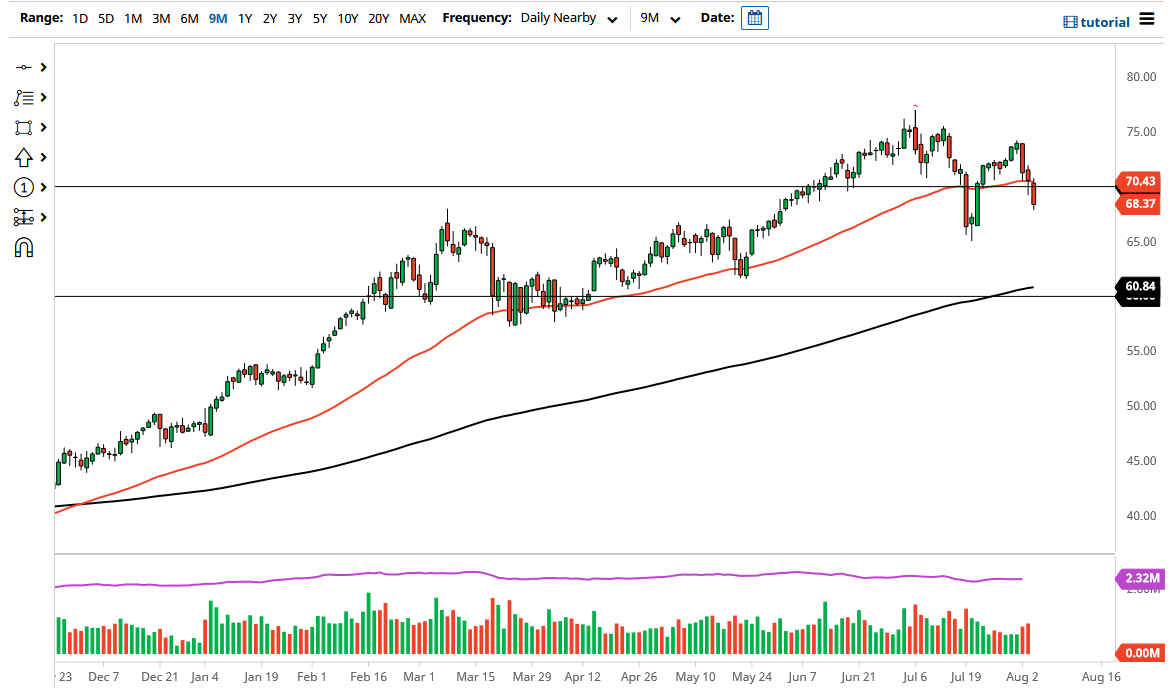

The West Texas Intermediate Crude Oil market fell a bit during the trading session on Wednesday again as there are a lot of concerns about growth. After all, the ADP numbers during the trading session were worse than anticipated, and recent inventory figures have shown that oil demand may be dropping a bit. With that being the case, it is not a huge surprise that we have formed the third red candlestick in a row, and now we are well below the 50-day EMA.

The $70 level being broken to the downside opens up the possibility of a move towards the $65 level. That is an area we have bounced from previously, so do not be surprised at all if this market finds that supportive. The hammer that sits in that same general area will offer a significant support by itself, so I think that is probably where the value hunters will come back into the picture. Furthermore, we also have the 200-day EMA breaking above the $60 level, and I think that would be an area where there would be a lot of interest.

However, when you look at this market, you can see that we have been in an uptrend for quite some time, and as we head towards the official jobs number, it is very likely that the market may have to try to revert to the mean. Nonetheless, this has been a very negative turn of events, and it certainly looks as if there are a lot of questions when it comes to the demand picture of crude oil. Ultimately, this is a market that I think will continue to see plenty of volatility more than anything else, but I think you will have to pay close attention to the US dollar as well. I anticipate that this is going to be a very noisy couple of days, as the $70 level looks to be more or less a magnet for price, so it is more likely than not going to be like trading the Bollinger Bands indicator. The crude oil market has a lot of questions to answer, and we may see difficult trading over the next 48 hours. Nonetheless, this is a market that I think will move right along with stock markets in general.