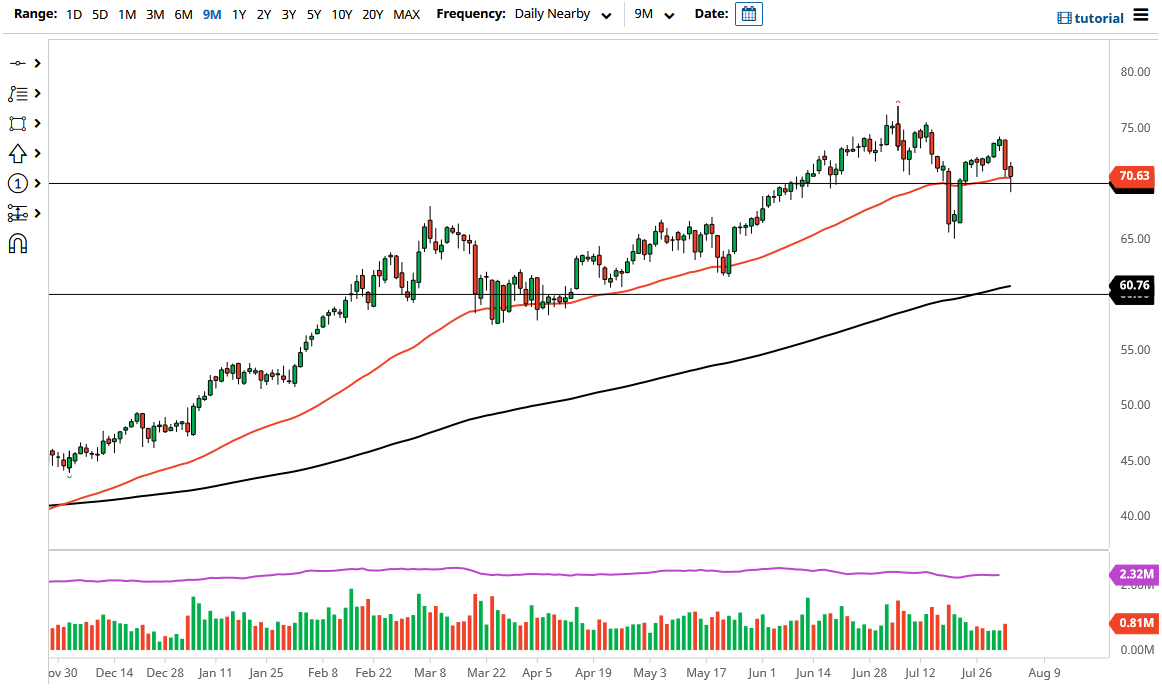

The West Texas Intermediate Crude Oil market fell rather hard during the trading session on Tuesday to pierce the $70 level to the downside. But the price turned around to show signs of life again in order to form a bit of a hammer. The question now is whether or not we can recover after this most recent selloff. One thing that you need to worry about is that we have not made a “higher high” in the market after the last selloff, so we still have to worry about structuring in general.

The shape of the candlestick does suggest that perhaps the $70 level will offer quite a bit of support, so it is worth paying close attention to whether or not we can break above the top of the candlestick. If we do, that might cause a lot of interest in the market to continue to push it to the upside, perhaps trying to take out the $75 level above. Breaking above the $75 level opens up the possibility of reaching towards the $77.50 level, and then a move towards the $80 level after that.

Keep in mind that a lot of this comes down to the idea of whether or not we are going to continue to see demand pick up as the “reopening trade” comes back into vogue. Delta variant issues have freaked people out, so it will be interesting to see how this plays out as we continue to see a bit of a “push/pull” type of dynamic when it comes to reopening economies and the amount of demand. While the markets will continue to look at this dynamic, we also have to pay close attention to the overall value of the US dollar, because that can also come into effect in this market as well. If we do break down below the bottom of the candlestick for the trading session on Tuesday, then I think we will go looking towards the $65 level, probably on a strengthening of the greenback. This is worth keeping in the back of your mind, as the euro looks like it is ready to fall against the greenback, and the British pound does not exactly scream strength at the moment either. The jobs number on Friday will also have its say over the next couple of days, but as things stand right now, we are still technically in an uptrend.