The EUR/USD's recent gains from its bullish rebound stopped at the 1.1845 resistance level and settled around 1.1796 as of this writing. The pair is waiting for stronger catalysts to complete the correction or return to the general bearish long-term trend. The euro's recent momentum evaporated from the announcement that European consumer prices rose more than expected in August, buoyed in large part by more expensive fuels. Economists say the jump is temporary, but it may raise questions about how long inflation will continue to rise. The 19 countries using the euro saw their inflation rate rise to 3.0% annually in August, up from 2.2% in July, according to figures from the European Union statistics agency Eurostat.

The increase was quite significant in part because some prices were much lower a year ago due to one-off factors linked to the coronavirus pandemic.

Where oil prices, after falling prices a year ago during the depths of the pandemic recession, contributed to a 15.4% rise in energy costs. Neglecting volatile fuels and food, core inflation was 1.6%. The latest figure also reflects other transitional factors, such as the timing of summer retail sales in France and Italy, and the end of German tax cuts on retail purchases. Economists have cited a host of additional reasons for the recent price hike in Europe. Where some hotels and tourism companies raised prices after the end of the epidemic closures, while supply chain disruptions and high prices for raw materials led to higher prices for commodity producers with the recovery of economic activity.

The issue of inflation has received global attention, especially after the annual rate of inflation in the United States reached 5.4% in July. The IMF says it expects inflation to return to pre-pandemic levels in most countries next year, but adds that there is a great deal of uncertainty about that. It warned that central banks may need to take action if price increases prove more steady than expected.

Since many factors are temporary, economists do not expect the ECB to try to counter inflation by cutting back on stimuli or raising interest rates. The central bank's latest forecast from June suggests that the inflation rate will reach 1.9% for the whole year, and drop to 1.5% next year. The European Central Bank's Governing Council will then meet on 9 September to review its policy stance.

However, the rise in inflation is gaining public attention, as evidenced by the front page of the German newspaper Bild that shouted a “new inflation shock” after German figures came in at 3.4% based on inflation results in many regions, the highest in 13 years. High inflation expectations could play a role in German unions' demands for wages in upcoming negotiations, according to Carsten Brzeski, global head of macro research at ING Bank. A member of the European Central Bank's Governing Council, German Jens Weidmann, warned that inflation could rise to 5% and then fall, although the future path is uncertain.

The higher numbers come after an extended period of low inflation that is below the ECB's target of falling but close to 2%. The bank recently revised the target to allow for brief periods of inflation above 2%. And inflation has been low across the developed world for years, as economists theorize that causes could include digitization, an aging population, and global competition in labor markets.

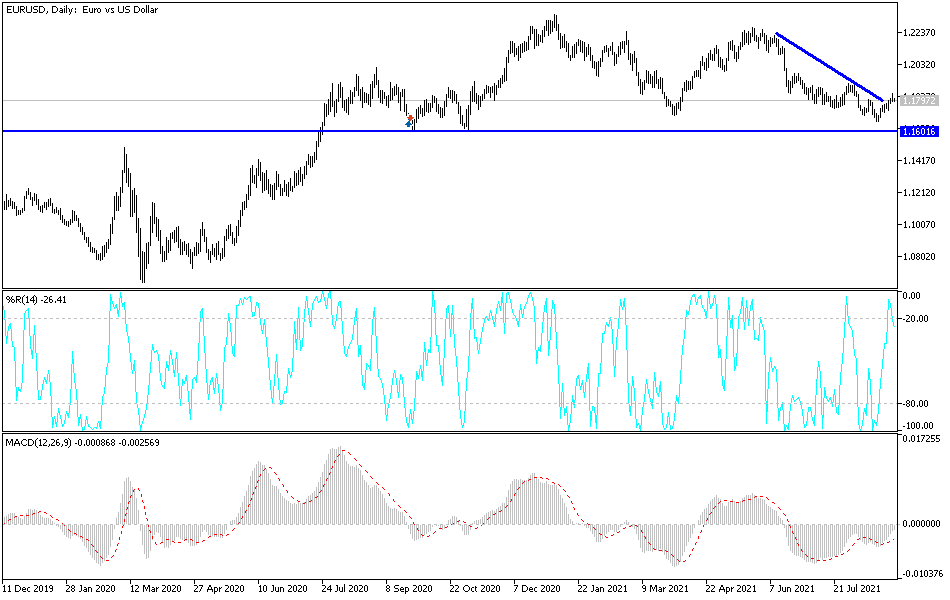

Technical analysis of the pair

On the daily chart, the EUR/USD is still at the beginning of an upward correction phase, which it needs more momentum to complete. The bulls need to break through the 1.2000 psychological resistance in order to move higher. In the current situation, the pair's decline below the support level 1.1760 will negatively affect the current correction, and the bears may start moving lower again towards stronger support levels at 1.1690 and 1.1580, which are good buying levels.

The Manufacturing PMI reading for the Eurozone economies will be announced. From the US, the ADP reading to measure the change in non-farm payrolls, the ISM Manufacturing PMI and the Construction Spending Index.