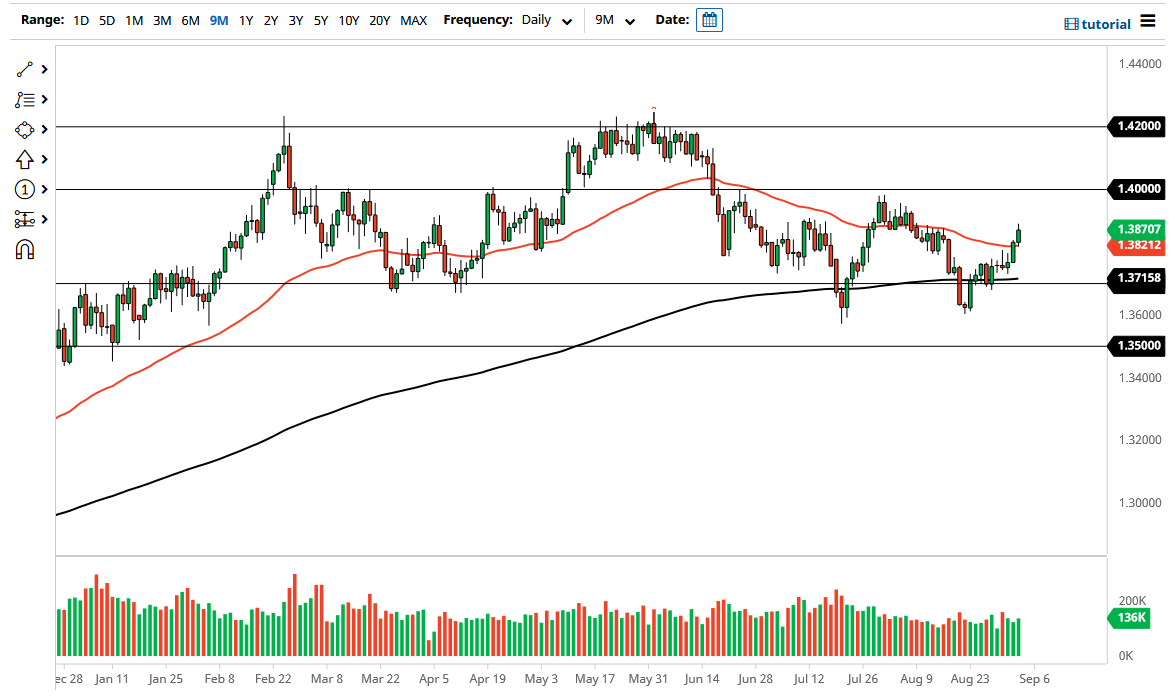

The British pound rallied significantly on Friday as the jobs number disappointed. That being the case, we did give back a little bit of the gains near 1.39, and now we have to ask questions about whether or not the US dollar will get beaten down, or if people will start running towards the bond market. In a bit of irony, the fact that the jobs market is so poor in the United States, or at least much worse than anticipated, means that it is possible that we could see the US dollar get bid in a “safety bid.”

That being said, the most likely outcome is going to be that we go higher. Breaking above the top of the candlestick could open up the possibility of a move towards the 1.40 handle. The 1.40 handle has been crucial more than once, and as things stand right now it does look like the “double bottom” underneath may offer plenty of reasons to go higher over the longer term. With that being the case, I think that it is only a matter of time before the buyers return, but if we were to wipe out the Thursday candlestick then I would be concerned. Keep in mind that we have not made a “higher high” quite yet, but it certainly looks as if we are going to try to get there.

One thing is for certain: I think you can count on a lot of volatility in the short term, especially as the market has been all over the place as of late. As traders come back from the vacation season, this can possibly get the markets moving, but right now I just do not see a reason to get large in a position right now. Nonetheless, we are looking at this scenario through the process of being range-bound, but with most certainly an upward tilt. With that being the case, I think you need to be cautious with your position, but once it starts to work in your favor the market will be one that you can add to going forward. I anticipate a lot of choppy behavior, but ultimately it looks as if we are going to continue to press the 1.39 level unless we get a massive “risk off move.”