Weak investor sentiment and anxiety in the financial markets will not support long-term gains for the British pound against the rest of the other major currencies. The gains of the GBP/USD pair, which reached the resistance level of 1.3807, quickly evaporated, as the currency pair fell to the level of 1.3730, where it has settled as of this writing. Despite the recent performance of the pound, NatWest Markets still believes that the pound will remain supported as well as the UK has a well-defined exit strategy from the Covid-19 pandemic and the hurdle of another wave of restrictions appears too high, "which could play the role of the pound positively".

Figures from the Bank of England released yesterday showed that UK mortgage approvals fell to their lowest level in one year in July after the initial reduction of the stamp duty holiday. Home purchase approvals, an indicator of future borrowing, also fell in July to 75,152 from 80,272 in June. This was the lowest since July 2020, but remained above pre-February 2020 levels. The expected level was 78,600.

Commenting on the figures, Andrew Wishart, an economist at Capital Economics, said timely indications are that demand will be resilient even when the tax break ends completely in October, although a shortage of inventory for sale may constrain sales volumes.

Individuals paid off £1.36 billion of mortgage debt in July, after borrowing a record £17.7 billion in June. Total lending fell to its lowest level since June 2020 at 16.5 billion pounds. Moreover, the data showed that individuals did not borrow any additional consumer credit in July. The annual growth rate for all consumer credit remained subdued, declining slightly to 2.7% in July from -2.2% in June.

British non-financial companies borrowed £3.7 billion from banks in July, up from £1.5 billion in June. The annual growth rate for borrowing by all major companies remained subdued, at -3.1 percent. The net repayment by SMEs of £1.2 billion was the largest ever, and it follows average net borrowing of £2.7 billion per month since March 2020.

US consumer confidence fell in August to its lowest level since February amid growing concerns about the rapid spread of the delta variant of the coronavirus and concerns about rising inflation. Accordingly, the Conference Board reported that the Consumer Confidence Index fell to a reading of 113.8 in August, down from a revised 125.1 in July. It was the lowest level for the index since a reading of 95.2 in February. The July index was revised down from an initially reported 129.1 which followed a reading of 128.9 in June, the best showing since before the pandemic broke out in February 2020.

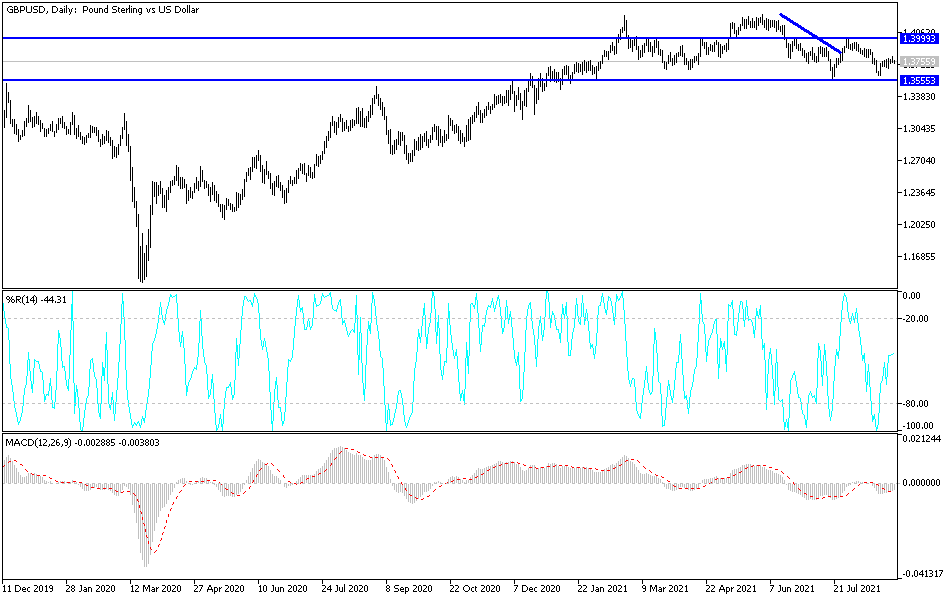

Technical analysis of the pair

Without the bulls moving towards the 1.4000 psychological resistance, the bullish correction will remain weak. The bears are currently moving towards the buying levels again, the most prominent of which are 1.3690 and 1.3580.

The pound will be affected today by the announcement of the British Manufacturing PMI, as well as the extent risk appetite. The US dollar will be affected today by the announcement of the ADP reading to measure the change in the number of US non-farm payrolls, the ISM Manufacturing PMI and the Construction Spending Index.