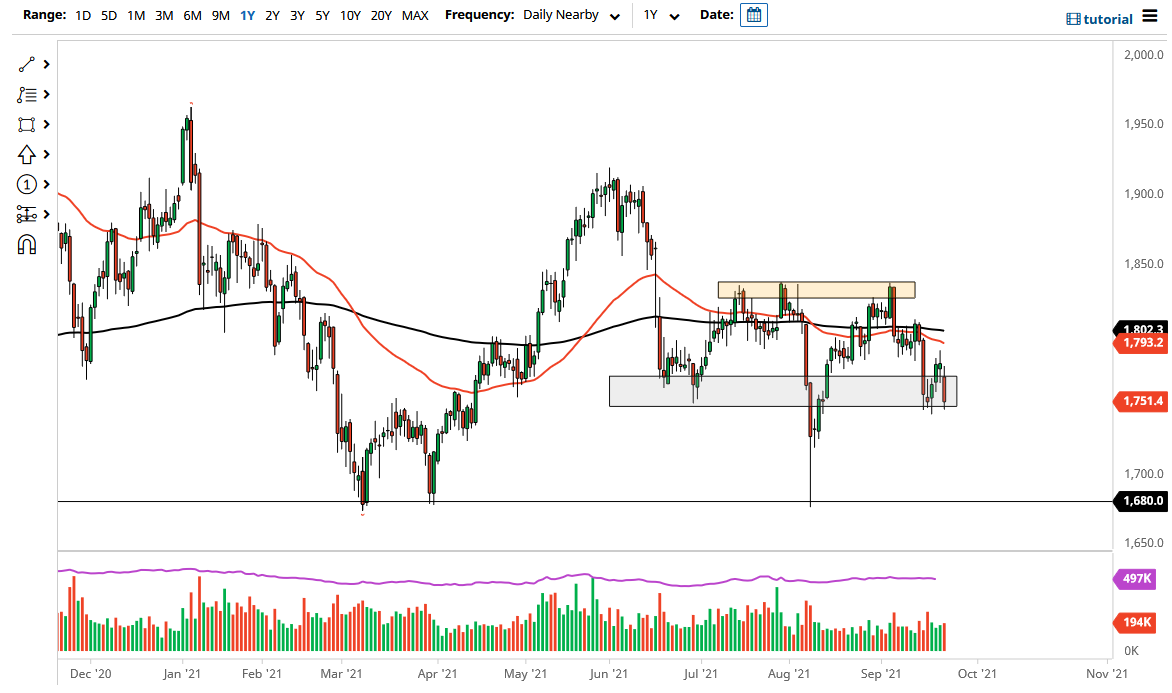

Gold markets have fallen rather hard during the trading session after initially filling the downward gap on Thursday. As we reached towards the $1750 level, the market is likely to see a significant break down at that point in time. If we were to break down below the $1750 region, the market then opens up a potential move down to the $1680 level. That of course is a major area of support in the past, so it will attract a lot of attention by traders out there watching this market.

If we were to break down below the $1680 level, it is very likely that the gold markets will fall apart at that point. I would anticipate a move towards the $1500 level, as it would be a major breach of support. The $1680 level is an area that has proven to be supportive more than once in the past, so I do think that there is a huge fight just waiting to happen if we get down there. That being said, the fact that we closed the way we did during the trading session on Thursday does suggest that perhaps we could very well see that move.

On the other hand, if we were to turn around and bounce from here, there is a lot of resistance above and it is very difficult to get bullish on gold at this point. We would need to see the US dollar fall apart in order to make that happen, and quite frankly you would have to be some type of drastic move. The market breaking above the top of the candlestick from the Wednesday session could open up the possibility of a move towards the 200 day EMA. Above there, then the market would change its attitude completely, perhaps reaching towards the $1835 level. The $1835 level has been a major resistance barrier and breaking above that could change the entirety of the market. I do not expect that to happen easily, and I certainly think that this is a “sell on the rallies” type of situation that we find ourselves in. I do think that this is going to be noisy market regardless of what happens, so that is something that you need to keep in the back of your mind and cognizant of when you are putting positions on as position sizing could be crucial.