Gold markets rallied ever so slightly on Wednesday as we continue to see more of an upward push in the market. Traders were a bit cautious ahead of the FOMC minutes, but it does seem as if they are trying to push back against the recent selling of gold. Nonetheless, I think there is still a significant amount of resistance above that you need to be very cognizant of.

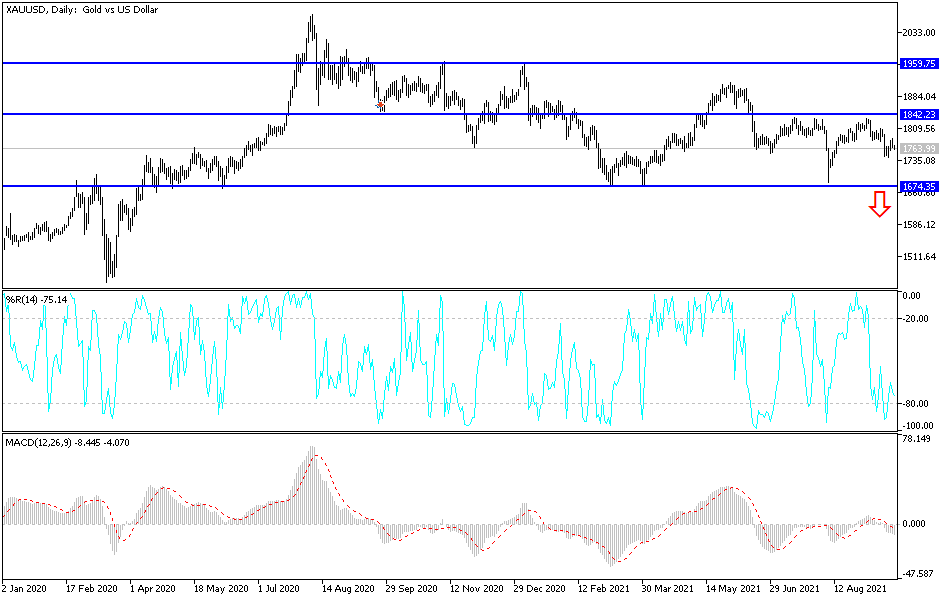

Looking at this chart, you can see that the 50-day EMA sits just below the $1800 level and is sloping lower. Perhaps more importantly, it is sitting at the top of the candlestick from the massive selloff from last week, and I think there are a lot of reasons to think that sellers would be in that vicinity. That being the case, the market is likely to find signs of exhaustion given enough time, and then the market will probably drop towards the $1750 level.

On the other hand, if we do take out the 200-day EMA to the upside, then it is likely that we could go looking towards the $1835 level. That is an area where we had seen a lot of selling pressure previously, so I think at this point we will eventually turn around in that area. However, if we were to close above the top of that level, then the gold market is likely to continue going higher, perhaps reaching towards the $1900 level. That would obviously be influenced by the US dollar, which tends to have a bit of a negative correlation to what happens in this market.

If we were to turn around a break down below the $1750 level, that would be an extraordinarily negative turn of events, because the bounce has been quite constructive. If that gives way, it is likely that we will go looking towards the $1680 level. That level for me is the absolute bottom of anything bullish or good coming out of the gold market. I think the one thing you can probably count on is that it is going to be volatile and choppy, but that is not necessarily out of sorts for the gold market. That being said, it does look like we are running out of momentum, at least in the short term.