The Federal Reserve re-affirmed its desire to tighten its monetary policy as soon as possible, which increased the gains of the US dollar, and thus downward pressure on gold. The metal fell to the support level of $1761 this morning, after attempts to rebound yesterday towards the $1788 level. The price of gold stabilized lower after the US Federal Reserve hinted at reducing its bond purchases in the near future and raising interest rates by the end of 2022. The Fed said that moderation in the pace of asset purchases may be justified if the US economy continues to advance as expected. The US central bank currently plans to continue its bond purchases at a rate of at least $120 billion per month, but the scaling is expected to begin later this year.

The Fed expects three interest rate increases in 2023 and three more in 2024.

US central bank officials also revised the forecast for US GDP growth in 2021 to 5.9% from 7%, while the forecast for GDP growth in 2022 was revised upwards to 3.8% from 3.3%. Core consumer price inflation is expected to reach 3.7% this year, compared to the 3% forecast in June. In its policy statement, the Fed described inflation as "high" but continued to attribute price growth to "transitional factors."

Before this announcement, the Bank of Japan said it will continue its ultra-easy monetary policy while the country battles the delta-induced coronavirus outbreak. Today, the Swiss Central Bank and the Bank of England will decide whether there is an opportunity for them to change their monetary policy or maintain the status quo. Any change will affect the sentiment of investors and, accordingly, the price of gold.

This week the prices of some commodities, including iron ore and copper, took a hit as the potential collapse of one of China's largest property developers raised concerns about the economy, and a possible decline in construction and demand for raw materials.

Analysts say "rising concerns" about Evergrande are raising concerns about a larger economic crisis in China that could put downward pressure on many goods that China consume. Evergrande threatened to default on debts of more than $300 billion, causing sharp losses in the US and global financial markets at the beginning of this week's trading.

Among the big questions for financial markets and investors is if this could this be China's "Lehman moment" - one that leads to a situation with more systemic risks than China realizes, and if the country will be able to contain the fallout from this crisis. Analysts said yes, referring to the bankruptcy of the global financial services company that contributed to the 2008 financial crisis.

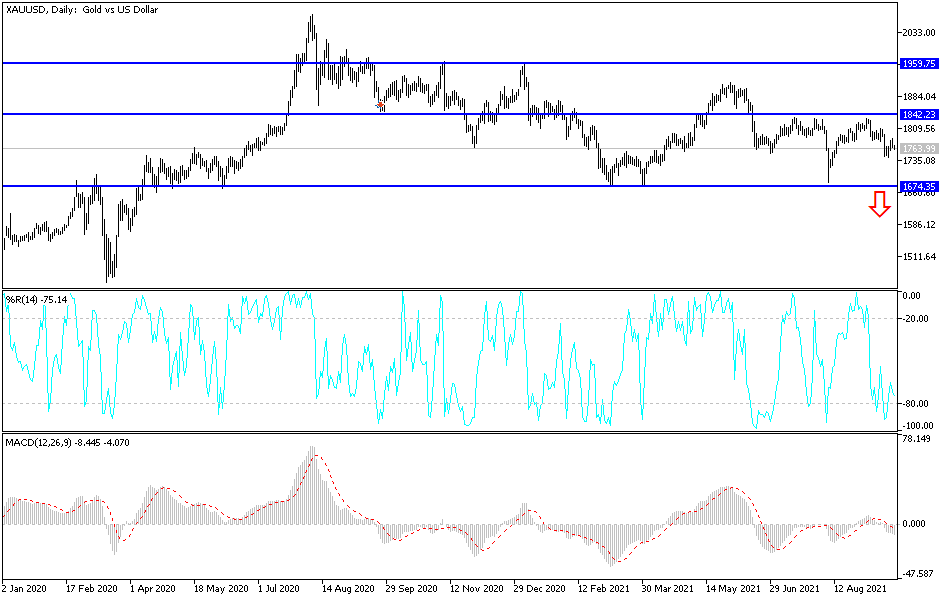

Technical analysis of gold

The bulls need to break through the psychological resistance of $1800 in order to control gold's performance.

The price of gold will be affected today by the strength of the US dollar and risk appetite, in addition to the decisions of the Swiss Central Bank, the Bank of England, and the readings of the Industrial Purchasing Managers’ Index and the Services PMI from the Eurozone, Britain and the United States of America.