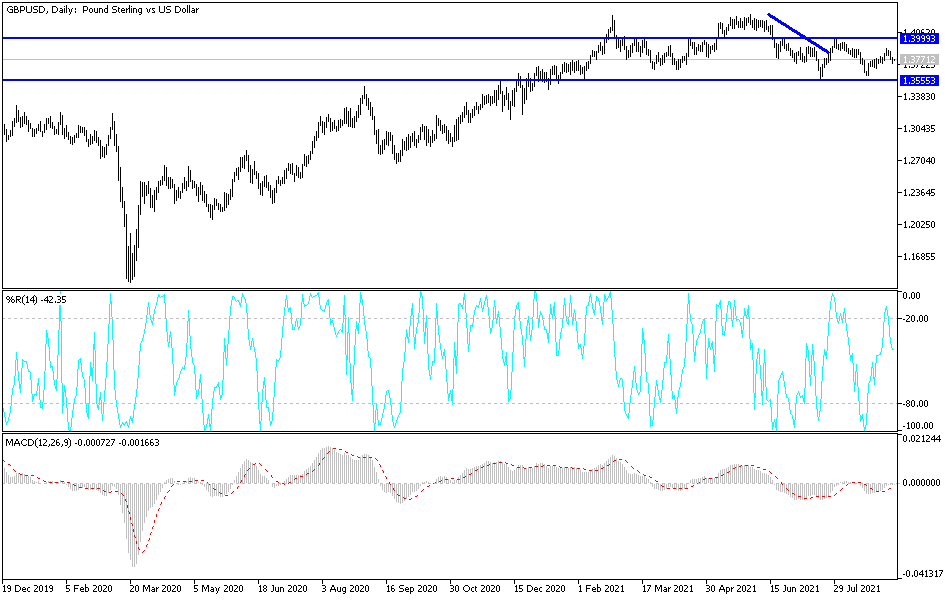

The British pound initially fell on Wednesday to reach down towards the 200-day EMA. By reaching down the way we have, the market has turned around to form a bit of a hammer in reaction to that very same 200-day EMA. The candle in and of itself is very bullish, and it does suggest that we could go higher. However, when you look at the longer-term charts, the structure of the market is not necessarily something that I am overly excited about.

The downtrend line that I have marked on the chart would have to be broken in order for me to get overly bullish of this market. In fact, when you look at the longer-term charts, you can make out a complex head and shoulders that has yet to kick off, but it most certainly starts to show the reality of just how precarious the entire situation is. If we were to break down below the 1.36 level, we would not only take out a double bottom, but I think we would kick off a major swing lower. In the short term, it looks like we will probably continue to fight, but until we break above that downtrend line, it is difficult to get overly excited about owning the British pound.

There is a really good chance that this has more to do with the US dollar than the British pound, so keep that in mind as well. By watching what is going on in the other currency pairs with the US dollar, you could get an idea as to what is happening here. The Federal Reserve is nowhere near tightening rates, but then again neither is anybody else. So now it comes down to global growth and the Delta variant. This is more confusion for the market that does not need any more, so I think we are going to continue to see a lot of choppy behavior. Again, if we can take out that downtrend line to the upside, then I might be willing to go long. Until then, I have to assume that short-term rallies will probably be sold into. One thing is for sure: you are probably better served by keeping your position size relatively small until we get at least the slightest hint of stability in one direction or the other.