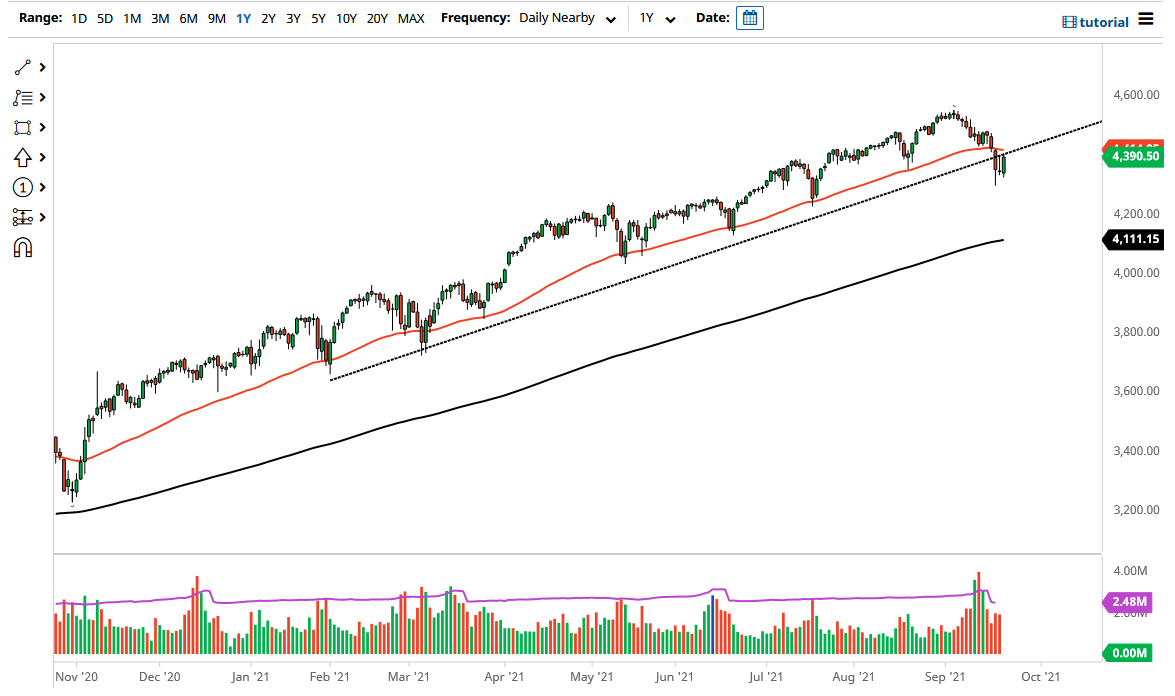

The S&P 500 rallied a bit on Wednesday as it awaited the FOMC minutes. It is probably only a matter of time before we see the market go higher, but we need a daily close above the 50-day EMA in order to get long again. The market has been bullish for very long time, but you should also note that there is a significant uptrend line that the market had followed for a while.

To the downside, if we were to take out the bottom of the candlestick from Monday, then it is likely that we could go much lower, perhaps reaching towards the 200-day EMA. In that scenario, I am a buyer of puts, but notice how I will not short this market. This is because the Federal Reserve will almost certainly say or do something to keep the market afloat. Recently, there have been headlines made due to the fact that several of the governors have been profiting from decisions. For the last 13 years the Federal Reserve has been working for Wall Street, and it has gotten to the point where everybody knows this. With that in mind, they will not allow the S&P 500 to drop drastically.

This becomes a self-fulfilling prophecy as the markets will continue to see this as the way things are going, and as a result it is likely that the Wall Street traders will take advantage of this, or at least the perception of this. If we do break to the upside, the market is likely to go towards the upside. The inverted hammer from the candlestick on Tuesday is worth noting as well because a break above that would obviously be a very bullish sign also. With this being the case, I believe that the market will continue to be noisy to say the least, but it is obviously a market that favors the upside over the longer term. I do not think it is can be easy, but there will be some type of narrative or reasoning to turn this market around in the next few days.