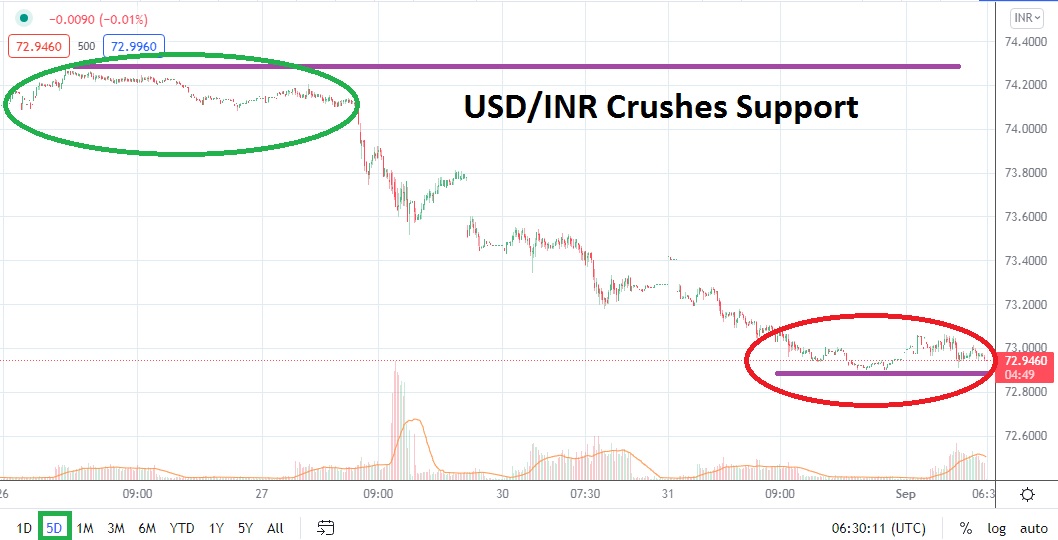

The past three days of trading within the USD/INR have seemingly answered many suspicions regarding the rather lofty prices the Forex pair occupied the past two-and-a-half months. The USD/INR has proven that perceptions about being overbought were correct. The dramatic violent spike down didn’t merely brush support levels aside, the bearish momentum crushed lower ratios. Speculators who were lucky enough to be anticipating more selling may have seen rather profitable trades produced within their trading accounts.

The past few weeks of trading had suggested that resistance levels were durable. However, the ability of USD/INR to not only sweep aside the 74.0000 level, but to puncture the 73.5000 mark and then proceed to the 73.0000 mark has been breathtaking, even for speculators who were fortunate enough to have bearish sentiment and be participating in the market. As of this writing, the USD/INR is traversing slightly under the 73.0000 value.

In case traders suspect the move has been too swift and it will be impossible for the USD/INR to decline further, they are reminded that the pair was trading around 72.3000 towards the end of May. The USD/INR was also trading near this price on the 23rd of March, when it actually produced a value of 72.2700 momentarily. However, before traders aim for these lower levels, it would be wise to look at three- and six-month charts to note the rather strong reversals higher which ensued after these low water marks were tested.

Technically, the USD/INR has certainly created a huge short-term impact with its sudden bearish spike, but for traders with a longer-term perspective – even if they are day traders – the Forex pair is now within price vicinity of a known range. However, admittedly, the current price range of the USD/INR is difficult to look at and not produce some nervousness regarding where the next few days of trading will prevail.

Not to be funny, but the trend has certainly been bearish, and after sustaining a wild path downwards, some natural reversals may occur short term. Traders who want to remain sellers are encouraged not to be overly ambitious and use take profit orders. The 73.0000 juncture may prove to be a solid barometer regarding sentiment, and if the price of the USD/INR maintains value beneath this level, it is possible that additional selling pressure could be seen near term. Traders should be prepared for the potential of volatility to appear taking into consideration the sweeping moves the USD/INR has seen the past few days.

Indian Rupee Short Term Outlook

Current Resistance: 73.0000

Current Support: 72.8640

High Target: 73.1200

Low Target: 72.7320