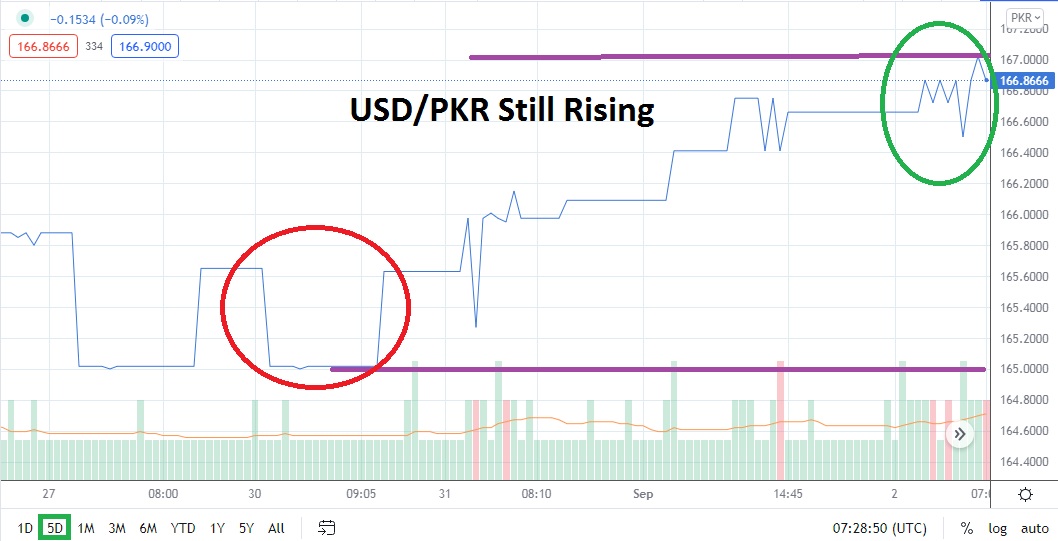

The USD/PKR has seen strong upwards momentum since the middle of July. On the 10th of May, the USD/PKR hit a low of nearly 151.8000, and this stronger bearish ratio touched values not seen since June 2020. However, since the second week of May, the USD/PKR has demonstrated a strong and startling bullish movement. Today’s values are approaching the record levels of the USD/PKR which were seen in March and August of last year, when the Forex pair touched the 168.2800 vicinity.

Questions about national debt are hurting Pakistan, even as some government ministers publically have stated better days are ahead. Coincidence or not, the USD/PKR has also seen a steady amount of bullish momentum develop as the situation in the neighboring country of Afghanistan becomes more problematic. Since the 12th of July, when the USD/PKR charged above the 160.7500 levels which had last been seen in January of this year and November of 2020, more demonstrative bullish activity has flourished.

Traders who are able to buy the USD/PKR and hold onto positions need to practice solid risk management. The USD/PKR doesn’t move in a one-way direction and sudden reversals lower must be protected against. August certainly produced an upwards climb in the USD/PKR, but from a technical perspective, moves lower can be seen on a one-month chart. Stop losses should be entered a safe distance from current price action, positions should not be overleveraged and patience may be required to carry a position until it develops favorable.

The USD/PKR does offer speculators a rather intriguing capability to trend in large durations of time. If the USD/PKR breaks through current resistance levels of 167.1000 and challenges junctures near the 167.2000 to 167.5000 near term it will raise speculative ambitions. There will be reason to suspect if the velocity of the bullish momentum continues that additional gains will be generated. The current economy and social conditions within Pakistan remain troubling on the surface as inflation concerns and its national debt create headaches domestically.

Traders tempted to buy the USD/PKR cannot be faulted. Perhaps waiting for slight reversals lower is a good decision for conservative speculators. However, the USD/PKR has been moving rather quickly in a higher fashion, so aggressive traders may want to buy using limit orders to make sure their price fills are executed fairly.

Pakistani Rupee Short-Term Outlook

Current Resistance: 167.1000

Current Support: 166.8000

High Target: 167.3000

Low Target: 166.6000